Question: Question. 2. The XYZ Co. Ltd. is considering the purchase of a new machine. Two alternative machines (A and B) have been suggested each costing

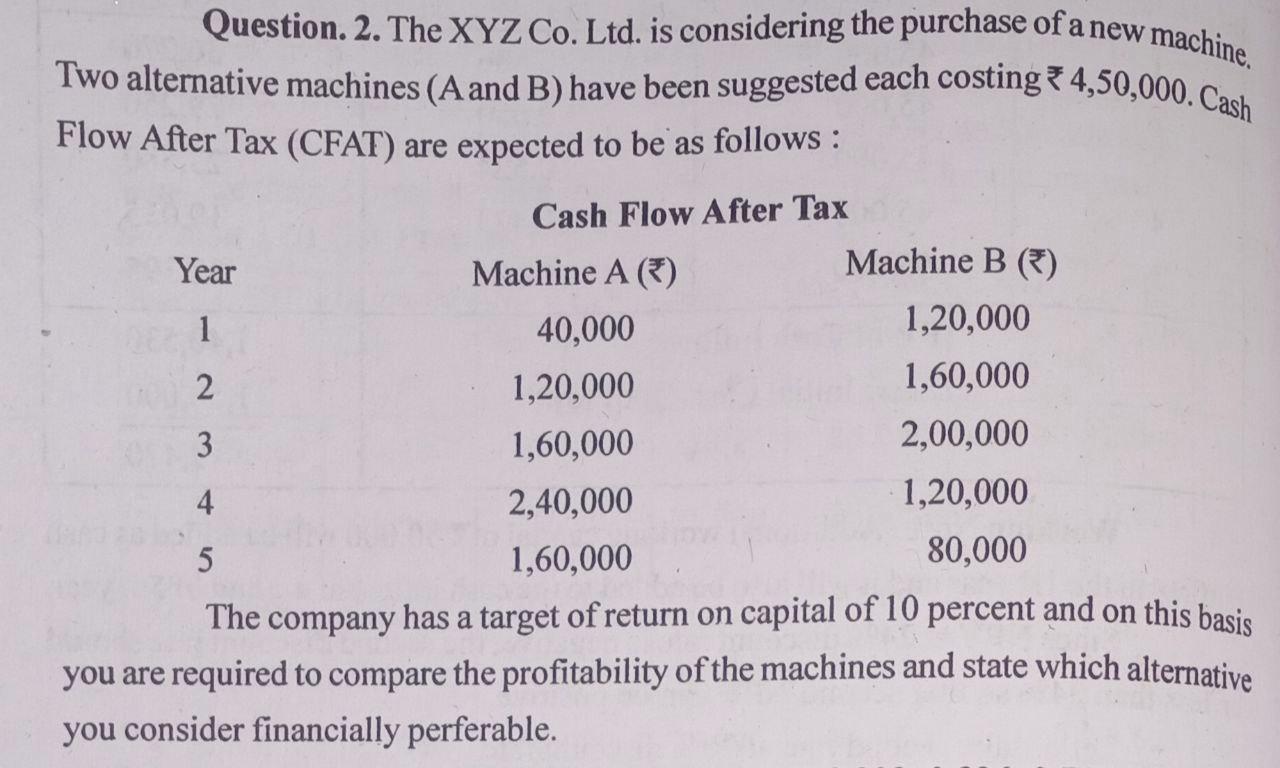

Question. 2. The XYZ Co. Ltd. is considering the purchase of a new machine. Two alternative machines (A and B) have been suggested each costing 4,50,000. Cash Flow After Tax (CFAT) are expected to be as follows: Cash Flow After Tax Year Machine A () Machine B () 1 40,000 1,20,000 2 1,20,000 1,60,000 3 1,60,000 2,00,000 4 2,40,000 1,20,000 5 1,60,000 80,000 The company has a target of return on capital of 10 percent and on this basis you are required to compare the profitability of the machines and state which alternative you consider financially perferable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock