Question: Question 2 Total Marks: 25 Hreon SA is an online technology company that provides services in outdated programming languages. As software upgrades, older languages such

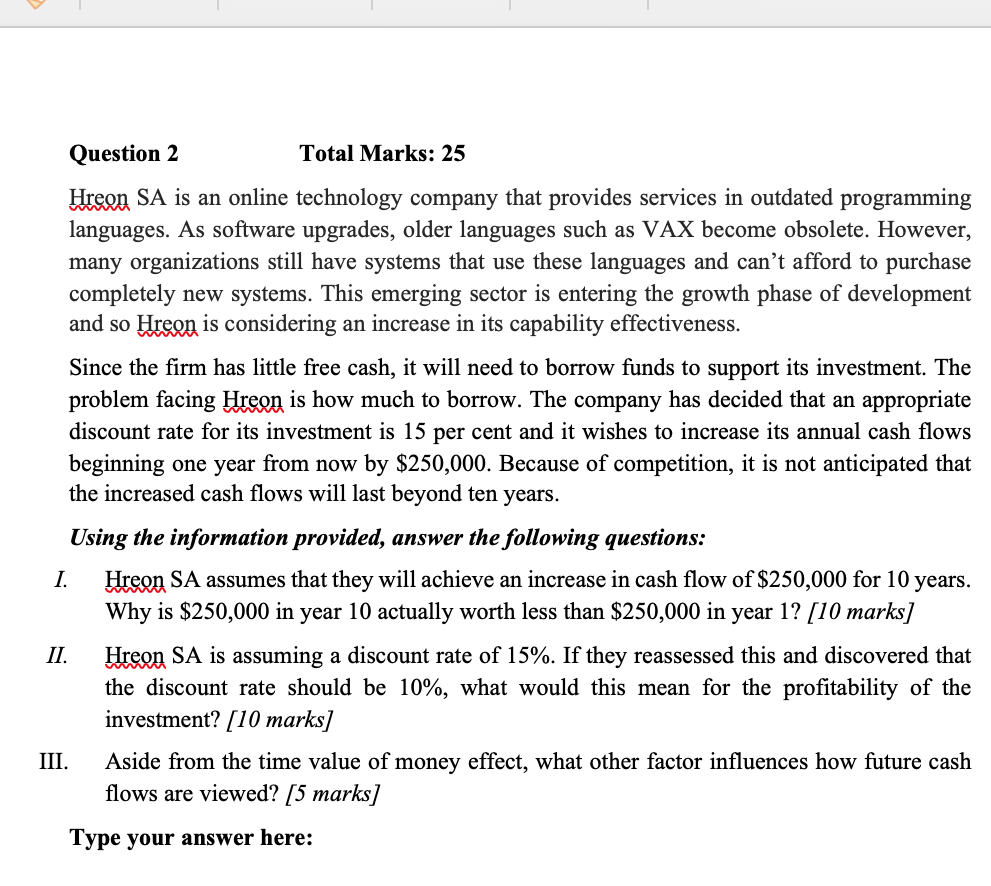

Question 2 Total Marks: 25 Hreon SA is an online technology company that provides services in outdated programming languages. As software upgrades, older languages such as VAX become obsolete. However, many organizations still have systems that use these languages and can't afford to purchase completely new systems. This emerging sector is entering the growth phase of development and so Hreon is considering an increase in its capability effectiveness. Since the firm has little free cash, it will need to borrow funds to support its investment. The problem facing Hreon is how much to borrow. The company has decided that an appropriate discount rate for its investment is 15 per cent and it wishes to increase its annual cash flows beginning one year from now by $250,000. Because of competition, it is not anticipated that the increased cash flows will last beyond ten years. Using the information provided, answer the following questions: 1. Hreon SA assumes that they will achieve an increase in cash flow of $250,000 for 10 years. Why is $250,000 in year 10 actually worth less than $250,000 in year 1? [10 marks] II. Hreon SA is assuming a discount rate of 15%. If they reassessed this and discovered that the discount rate should be 10%, what would this mean for the profitability of the investment? [10 marks] III. Aside from the time value of money effect, what other factor influences how future cash flows are viewed? (5 marks] Type your answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts