Question: Sarasota Bear Inc. is a retailer of nursery furniture. On April 1, 2020, Sarasota sold a nursery set to a customer and received a

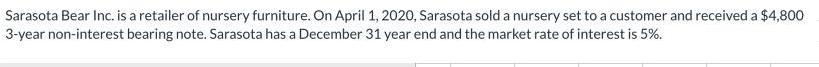

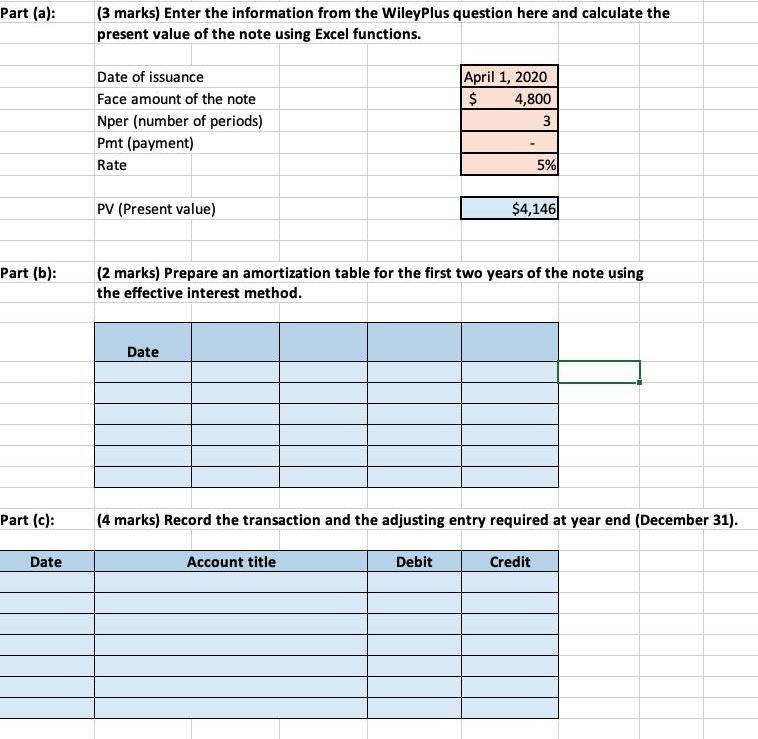

Sarasota Bear Inc. is a retailer of nursery furniture. On April 1, 2020, Sarasota sold a nursery set to a customer and received a $4,800 3-year non-interest bearing note. Sarasota has a December 31 year end and the market rate of interest is 5%. Part (a): (3 marks) Enter the information from the WileyPlus question here and calculate the present value of the note using Excel functions. April 1, 2020 4,800 Date of issuance Face amount of the note Nper (number of periods) 3 Pmt (payment) Rate 5% PV (Present value) $4,146 Part (b): (2 marks) Prepare an amortization table for the first two years of the note using the effective interest method. Date Part (c): (4 marks) Record the transaction and the adjusting entry required at year end (December 31). Date Account title Debit Credit Part (d): (3 marks) Show how the note should be reported on the company's year end balance sheet. Be specific as to classification and amount Balance Sheet (partial) December 31, 20XX (enter the correct year)

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Welly Plus Part a Given data Date of issuance April 1 2020 Face amount of the note 4800 Nper No of periods 3 Pmt Rate 5 PV Present value 4146420473 Pa... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

625666b17b208_Book852.xlsx

300 KBs Excel File