Question: Question 2 USX is considering adding an additional furnace that will operate for ten years. Last year the company commissioned a feasibility study that cost

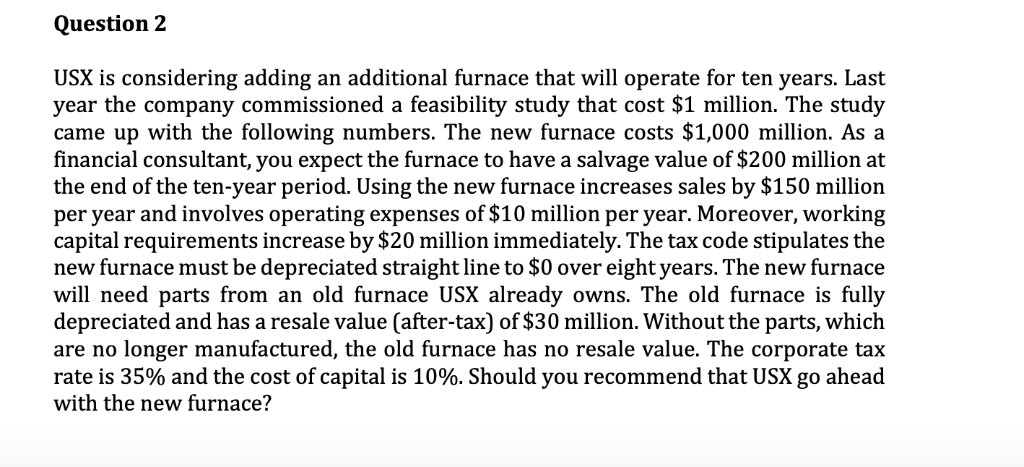

Question 2 USX is considering adding an additional furnace that will operate for ten years. Last year the company commissioned a feasibility study that cost $1 million. The study came up with the following numbers. The new furnace costs $1,000 million. As a financial consultant, you expect the furnace to have a salvage value of $200 million at the end of the ten-year period. Using the new furnace increases sales by $150 million per year and involves operating expenses of $10 million per year. Moreover, working capital requirements increase by $20 million immediately. The tax code stipulates the new furnace must be depreciated straight line to $0 over eight years. The new furnace will need parts from an old furnace USX already owns. The old furnace is fully depreciated and has a resale value (after-tax) of $30 million. Without the parts, which are no longer manufactured, the old furnace has no resale value. The corporate tax rate is 35% and the cost of capital is 10%. Should you recommend that USX go ahead with the new furnace

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts