Question: Question 2 Value at Risk (Historical Data Method) Suppose ABC insurance company invests $500,000 in the S&P 500 index in the period Jan 1, 2007

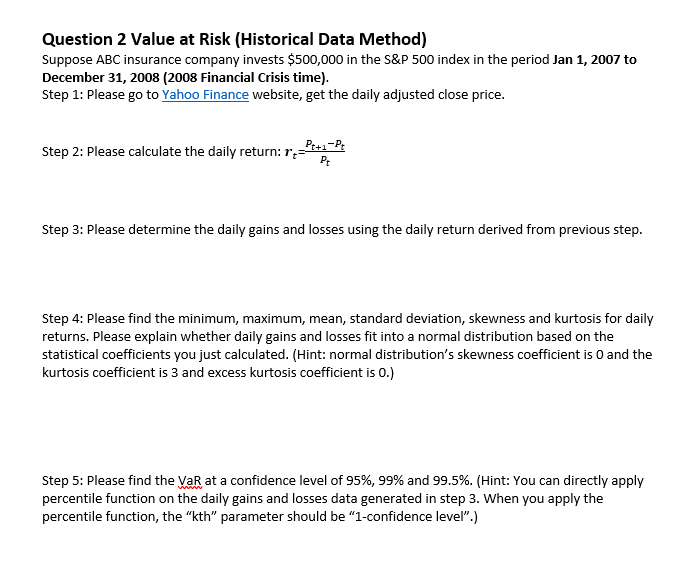

Question 2 Value at Risk (Historical Data Method) Suppose ABC insurance company invests $500,000 in the S\&P 500 index in the period Jan 1, 2007 to December 31, 2008 (2008 Financial Crisis time). Step 1: Please go to website, get the daily adjusted close price. Step 2: Please calculate the daily return: rt=PtPt+1Pt Step 3: Please determine the daily gains and losses using the daily return derived from previous step. Step 4: Please find the minimum, maximum, mean, standard deviation, skewness and kurtosis for daily returns. Please explain whether daily gains and losses fit into a normal distribution based on the statistical coefficients you just calculated. (Hint: normal distribution's skewness coefficient is 0 and the kurtosis coefficient is 3 and excess kurtosis coefficient is 0 .) Step 5: Please find the VaR at a confidence level of 95%,99% and 99.5%. (Hint: You can directly apply percentile function on the daily gains and losses data generated in step 3 . When you apply the percentile function, the "kth" parameter should be "1-confidence level".)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts