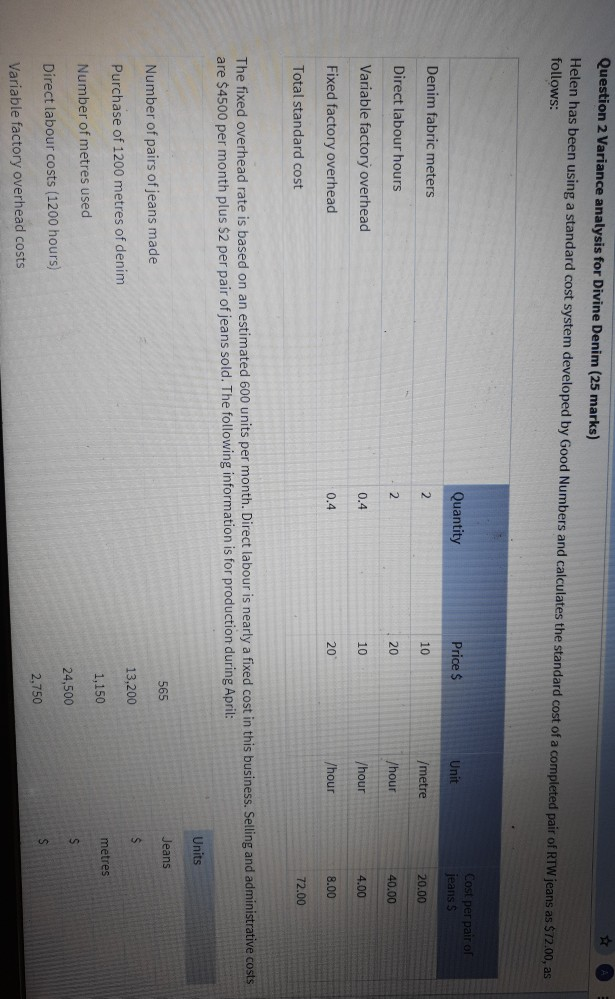

Question: Question 2 Variance analysis for Divine Denim (25 marks) Helen has been using a standard cost system developed by Good Numbers and calculates the standard

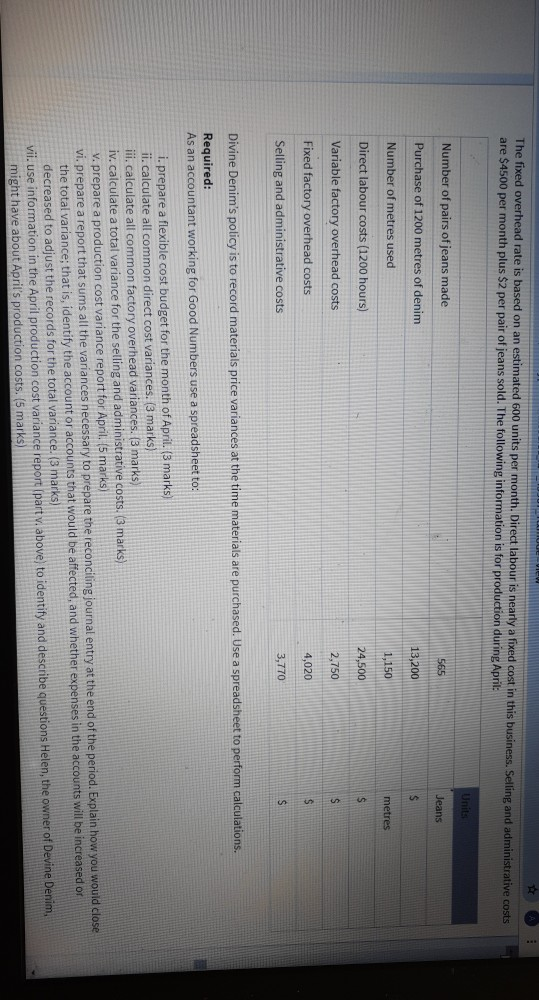

Question 2 Variance analysis for Divine Denim (25 marks) Helen has been using a standard cost system developed by Good Numbers and calculates the standard cost of a completed pair of RTW jeans as $12.00, as follows: Quantity Price $ Unit Cost per pair of jeans S Denim fabric meters 10 metre 20.00 Direct labour hours 20 /hour 40.00 Variable factory overhead 0.4 /hour 4.00 Fixed factory overhead 0.4 /hour 8.00 Total standard cost 72.00 The fixed overhead rate is based on an estimated 600 units per month. Direct labour is nearly a fixed cost in this business. Selling and administrative costs are $4500 per month plus $2 per pair of jeans sold. The following information is for production during April: Units 565 Jeans Number of pairs of jeans made Purchase of 1200 metres of denim 13,200 1,150 metres Number of metres used 24,500 Direct labour costs (1200 hours) 2,750 Variable factory overhead costs The fixed overhead rate is based on an estimated 600 units per month. Direct labour is nearly a fixed cost in this business. Selling and administrative costs are $4500 per month plus $2 per pair of jeans sold. The following information is for production during April Units Number of pairs of jeans made 565 Jeans Purchase of 1200 metres of denim 13,200 Number of metres used 1,150 metres Direct labour costs (1200 hours) 24,500 Variable factory overhead costs 2,750 Fixed factory overhead costs 4,020 Selling and administrative costs 3,770 Divine Denim's policy is to record materials price variances at the time materials are purchased. Use a spreadsheet to perform calculations. Required: As an accountant working for Good Numbers use a spreadsheet to: i. prepare a flexible cost budget for the month of April. (3 marks) ii. calculate all common direct cost variances. (3 marks) iii. calculate all common factory overhead variances. (3 marks) iv. calculate a total variance for the selling and administrative costs. (3 marks) v. prepare a production cost variance report for April. (5 marks) vi, prepare a report that sums all the variances necessary to prepare the reconciling journal entry at the end of the period. Explain how you would close the total variance; that is, identify the account or accounts that would be affected, and whether expenses in the accounts will be increased or decreased to adjust the records for the total variance. (3 marks) vii. use information in the April production cost variance report (part v. above) to identify and describe questions Helen, the owner of Devine Denim might have about April's production costs. (5 marks) Question 2 Variance analysis for Divine Denim (25 marks) Helen has been using a standard cost system developed by Good Numbers and calculates the standard cost of a completed pair of RTW jeans as $12.00, as follows: Quantity Price $ Unit Cost per pair of jeans S Denim fabric meters 10 metre 20.00 Direct labour hours 20 /hour 40.00 Variable factory overhead 0.4 /hour 4.00 Fixed factory overhead 0.4 /hour 8.00 Total standard cost 72.00 The fixed overhead rate is based on an estimated 600 units per month. Direct labour is nearly a fixed cost in this business. Selling and administrative costs are $4500 per month plus $2 per pair of jeans sold. The following information is for production during April: Units 565 Jeans Number of pairs of jeans made Purchase of 1200 metres of denim 13,200 1,150 metres Number of metres used 24,500 Direct labour costs (1200 hours) 2,750 Variable factory overhead costs The fixed overhead rate is based on an estimated 600 units per month. Direct labour is nearly a fixed cost in this business. Selling and administrative costs are $4500 per month plus $2 per pair of jeans sold. The following information is for production during April Units Number of pairs of jeans made 565 Jeans Purchase of 1200 metres of denim 13,200 Number of metres used 1,150 metres Direct labour costs (1200 hours) 24,500 Variable factory overhead costs 2,750 Fixed factory overhead costs 4,020 Selling and administrative costs 3,770 Divine Denim's policy is to record materials price variances at the time materials are purchased. Use a spreadsheet to perform calculations. Required: As an accountant working for Good Numbers use a spreadsheet to: i. prepare a flexible cost budget for the month of April. (3 marks) ii. calculate all common direct cost variances. (3 marks) iii. calculate all common factory overhead variances. (3 marks) iv. calculate a total variance for the selling and administrative costs. (3 marks) v. prepare a production cost variance report for April. (5 marks) vi, prepare a report that sums all the variances necessary to prepare the reconciling journal entry at the end of the period. Explain how you would close the total variance; that is, identify the account or accounts that would be affected, and whether expenses in the accounts will be increased or decreased to adjust the records for the total variance. (3 marks) vii. use information in the April production cost variance report (part v. above) to identify and describe questions Helen, the owner of Devine Denim might have about April's production costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts