Question: Question 2. WACC (1 points) Using the financial information provided, complete the table below and find the weighted- average-cost-of-capital (WACC) for the company. Question 4.

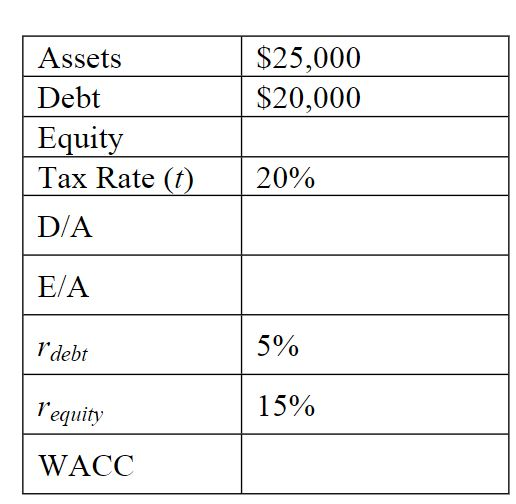

Question 2. WACC (1 points)

Using the financial information provided, complete the table below and find the weighted-

average-cost-of-capital (WACC) for the company.

Question 4. Bond pricing (2 points)

A municipal bond with a par value of $1,000 and a maturity of 5 years has a coupon rate of 7%

paid annually and the required rate of return for investors is 5%.

a) Calculate the bond value.

b) Does the bond sell at par, premium, or discount? Explain why.

Assets Debt $25,000 $20,000 Equity Tax Rate (t) D/A 20% E/A r'debt 5% l'equity 15% WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts