Question: Question 2 When a firm has cash flow problems, there are often negative feedback effects. For example, the firm may need to cut capital expenditures

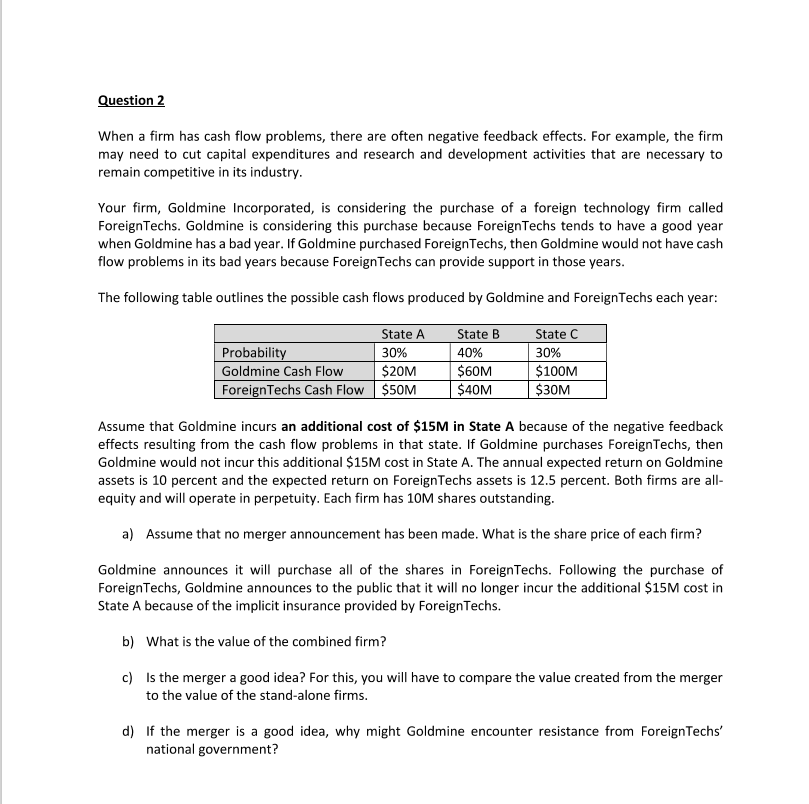

Question 2 When a firm has cash flow problems, there are often negative feedback effects. For example, the firm may need to cut capital expenditures and research and development activities that are necessary to remain competitive in its industry. Your firm, Goldmine Incorporated, is considering the purchase of a foreign technology firm called Foreign Techs. Goldmine is considering this purchase because ForeignTechs tends to have a good year when Goldmine has a bad year. If Goldmine purchased ForeignTechs, then Goldmine would not have cash flow problems in its bad years because ForeignTechs can provide support in those years. The following table outlines the possible cash flows produced by Goldmine and ForeignTechs each year: State A Probability 30% Goldmine Cash Flow $20M ForeignTechs Cash Flow $50M State B 40% $60M $40M State C 30% $100M $30M Assume that Goldmine incurs an additional cost of $15M in State A because of the negative feedback effects resulting from the cash flow problems in that state. If Goldmine purchases ForeignTechs, then Goldmine would not incur this additional $15M cost in State A. The annual expected return on Goldmine assets is 10 percent and the expected return on ForeignTechs assets is 12.5 percent. Both firms are all- equity and will operate in perpetuity. Each firm has 10M shares outstanding. a) Assume that no merger announcement has been made. What is the share price of each firm? Goldmine announces it will purchase all of the shares in ForeignTechs. Following the purchase of ForeignTechs, Goldmine announces to the public that it will no longer incur the additional $15M cost in State A because of the implicit insurance provided by ForeignTechs. b) What is the value of the combined firm? c) Is the merger a good idea? For this, you will have to compare the value created from the merger to the value of the stand-alone firms. d) If the merger is a good idea, why might Goldmine encounter resistance from ForeignTechs' national government

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts