Question: QUESTION 2: Yisoon Red Box (YRB) is considering replacing its current semi-automated folding machine with an automated one. Information on the existing and the proposed

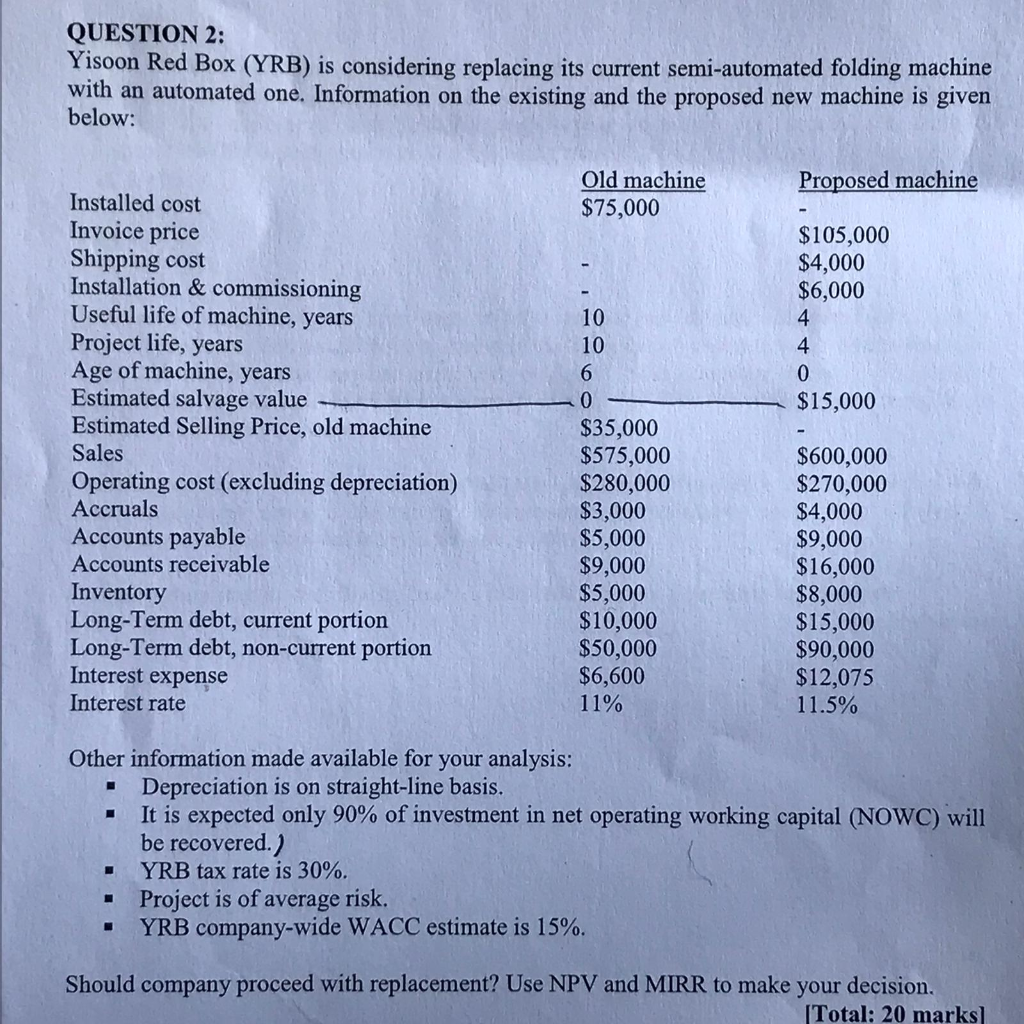

QUESTION 2: Yisoon Red Box (YRB) is considering replacing its current semi-automated folding machine with an automated one. Information on the existing and the proposed new machine is given below: Old machine Proposed machine Installed cost Invoice price Shipping cost Installation & commissioning Useful life of machine, years Project life, years Age of machine, years Estimated salvage value Estimated Selling Price, old machine Sales $75,000 $105,000 $4,000 $6,000 4 4 10 10 $15,000 $35,000 $575,000 $280,000 $3,000 $5,000 $9,000 $5,000 $10,000 $50,000 $6,600 11% S600,000 $270,000 $4,000 $9,000 Operating cost (excluding depreciation) Accruals Accounts payable Accounts receivable $16,000 $8,000 $15,000 $90,000 $12,075 Inventory Long-Term debt, current portion Long-Term debt, non-current portion Interest expense Interest rate 11.5% Other information made available for your analysis Depreciation is on straight-line basis. . It is expected only 90% of investment in net operating working capital (NOWC) will be recovered.) YRB tax rate is 30%. - Project is of average risk YRB company-wide WACC estimate is 15%. Should company proceed with replacement? Use NPV and MIRR to make your decision. Total: 20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts