Question: Question 2 You are valuing Therapox Inc. using the top-down growth approach. You would like to forecast revenues at the end of the 5 year

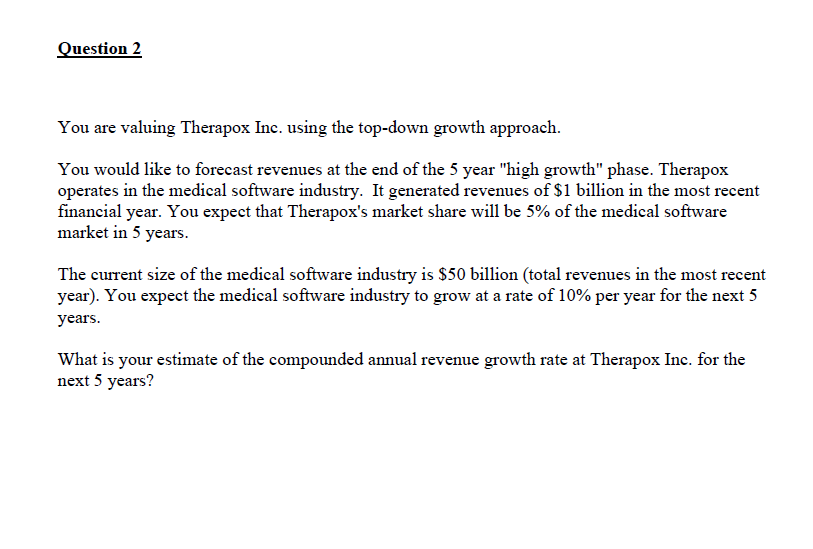

Question 2 You are valuing Therapox Inc. using the top-down growth approach. You would like to forecast revenues at the end of the 5 year "high growth" phase. Therapox operates in the medical software industry. It generated revenues of $1 billion in the most recent financial year. You expect that Therapox's market share will be 5% of the medical software market in 5 years. The current size of the medical software industry is $50 billion (total revenues in the most recent year). You expect the medical software industry to grow at a rate of 10% per year for the next 5 years. What is your estimate of the compounded annual revenue growth rate at Therapox Inc. for the next 5 years? Question 2 You are valuing Therapox Inc. using the top-down growth approach. You would like to forecast revenues at the end of the 5 year "high growth" phase. Therapox operates in the medical software industry. It generated revenues of $1 billion in the most recent financial year. You expect that Therapox's market share will be 5% of the medical software market in 5 years. The current size of the medical software industry is $50 billion (total revenues in the most recent year). You expect the medical software industry to grow at a rate of 10% per year for the next 5 years. What is your estimate of the compounded annual revenue growth rate at Therapox Inc. for the next 5 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts