Question: Question 2 You have been tasked with managing the purchase and replacement plan for the company car. The new car to be purchased today costs

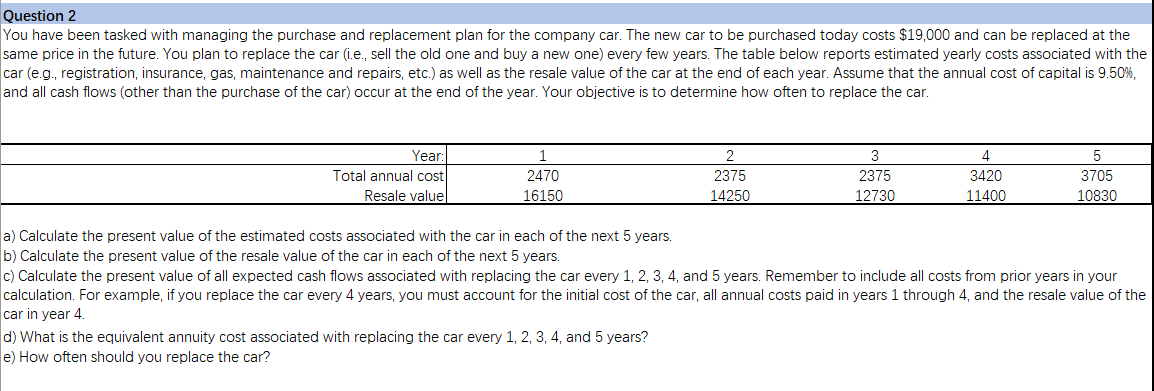

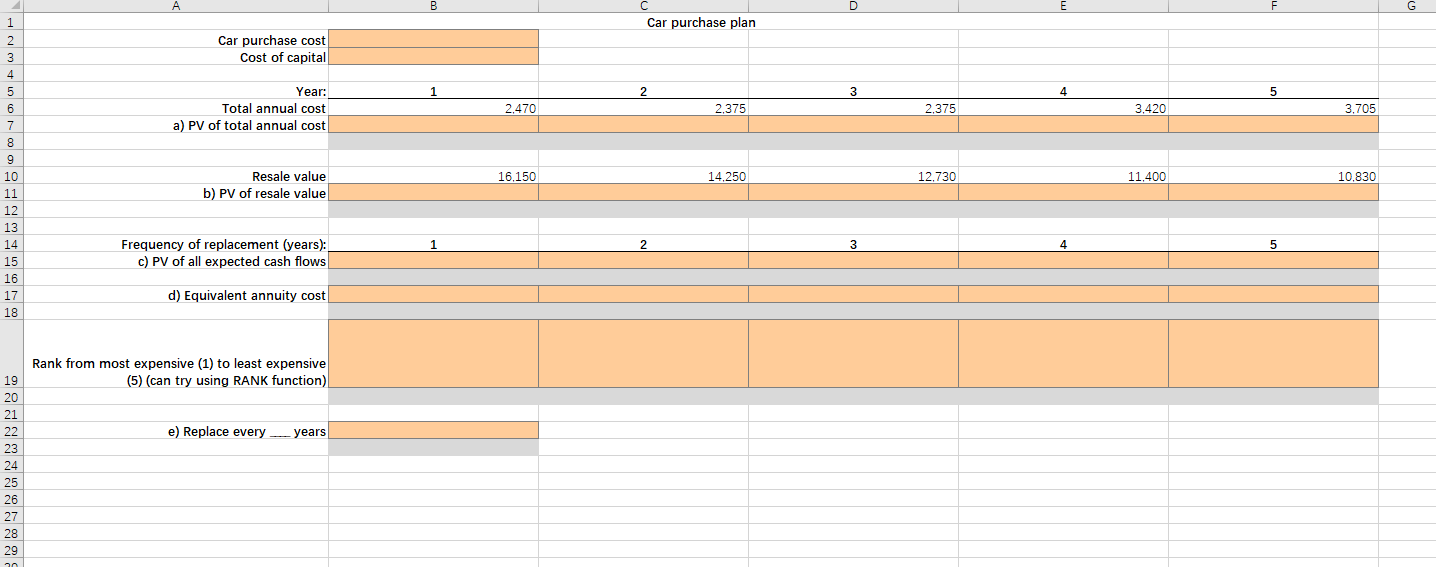

Question 2 You have been tasked with managing the purchase and replacement plan for the company car. The new car to be purchased today costs $19,000 and can be replaced at the same price in the future. You plan to replace the car (i.e., sell the old one and buy a new one) every few years. The table below reports estimated yearly costs associated with the car (e.g., registration, insurance, gas, maintenance and repairs, etc.) as well as the resale value of the car at the end of each year. Assume that the annual cost of capital is 9.50%, and all cash flows (other than the purchase of the car) occur at the end of the year. Your objective is to determine how often to replace the car. Year: Total annual cost Resale value 1 2470 16150 2 2375 14250 3 2375 12730 4 3420 11400 5 3705 10830 a) Calculate the present value of the estimated costs associated with the car in each of the next 5 years. b) Calculate the present value of the resale value of the car in each of the next 5 years. c) Calculate the present value of all expected cash flows associated with replacing the car every 1, 2, 3, 4, and 5 years. Remember to include all costs from prior years in your calculation. For example, if you replace the car every 4 years, you must account for the initial cost of the car, all annual costs paid in years 1 through 4, and the resale value of the car in year 4. d) What is the equivalent annuity cost associated with replacing the car every 1, 2, 3, 4, and 5 years? e) How often should you replace the car? A B D E F G Car purchase plan Car purchase cost Cost of capital 1 2 3 4 5 6 7 8 9 1 2 3 4 5 Year: Total annual cost a) PV of total annual cost 2.470 2.375 2.375 3.420 3.705 16,150 14,250 12.730 11.400 10.830 Resale value b) PV of resale value 10 11 12 13 14 15 16 17 18 1 2 3 4 5 Frequency of replacement (years): c) PV of all expected cash flows d) Equivalent annuity cost Rank from most expensive (1) to least expensive 1 (5) (can try using RANK function) 19 20 21 22 e) Replace every years 23 24 25 26 27 28 29 Question 2 You have been tasked with managing the purchase and replacement plan for the company car. The new car to be purchased today costs $19,000 and can be replaced at the same price in the future. You plan to replace the car (i.e., sell the old one and buy a new one) every few years. The table below reports estimated yearly costs associated with the car (e.g., registration, insurance, gas, maintenance and repairs, etc.) as well as the resale value of the car at the end of each year. Assume that the annual cost of capital is 9.50%, and all cash flows (other than the purchase of the car) occur at the end of the year. Your objective is to determine how often to replace the car. Year: Total annual cost Resale value 1 2470 16150 2 2375 14250 3 2375 12730 4 3420 11400 5 3705 10830 a) Calculate the present value of the estimated costs associated with the car in each of the next 5 years. b) Calculate the present value of the resale value of the car in each of the next 5 years. c) Calculate the present value of all expected cash flows associated with replacing the car every 1, 2, 3, 4, and 5 years. Remember to include all costs from prior years in your calculation. For example, if you replace the car every 4 years, you must account for the initial cost of the car, all annual costs paid in years 1 through 4, and the resale value of the car in year 4. d) What is the equivalent annuity cost associated with replacing the car every 1, 2, 3, 4, and 5 years? e) How often should you replace the car? A B D E F G Car purchase plan Car purchase cost Cost of capital 1 2 3 4 5 6 7 8 9 1 2 3 4 5 Year: Total annual cost a) PV of total annual cost 2.470 2.375 2.375 3.420 3.705 16,150 14,250 12.730 11.400 10.830 Resale value b) PV of resale value 10 11 12 13 14 15 16 17 18 1 2 3 4 5 Frequency of replacement (years): c) PV of all expected cash flows d) Equivalent annuity cost Rank from most expensive (1) to least expensive 1 (5) (can try using RANK function) 19 20 21 22 e) Replace every years 23 24 25 26 27 28 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts