Question: Question 2 You own a stock that has a current price of $80. A six-month call option on this stock with an exercise price of

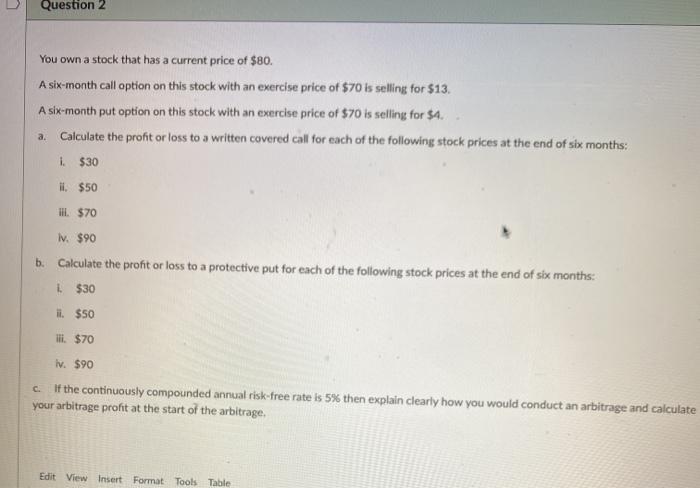

Question 2 You own a stock that has a current price of $80. A six-month call option on this stock with an exercise price of $70 is selling for $13. A six-month put option on this stock with an exercise price of $70 is selling for $4. Calculate the profit or loss to a written covered call for each of the following stock prices at the end of six months: i $30 ii. $50 III. $70 iv. $90 b. Calculate the profit or loss to a protective put for each of the following stock prices at the end of six months: L$30 il. $50 ili $70 iv. $90 If the continuously compounded annual risk-free rate is 5% then explain clearly how you would conduct an arbitrage and calculate your arbitrage profit at the start of the arbitrage, Edit View Insert Format Tools Table Format

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts