Question: Please solve entire problem, Thank you :) 20 pts You own a stock that has a current price of $80. A six-month call option on

Please solve entire problem, Thank you :)

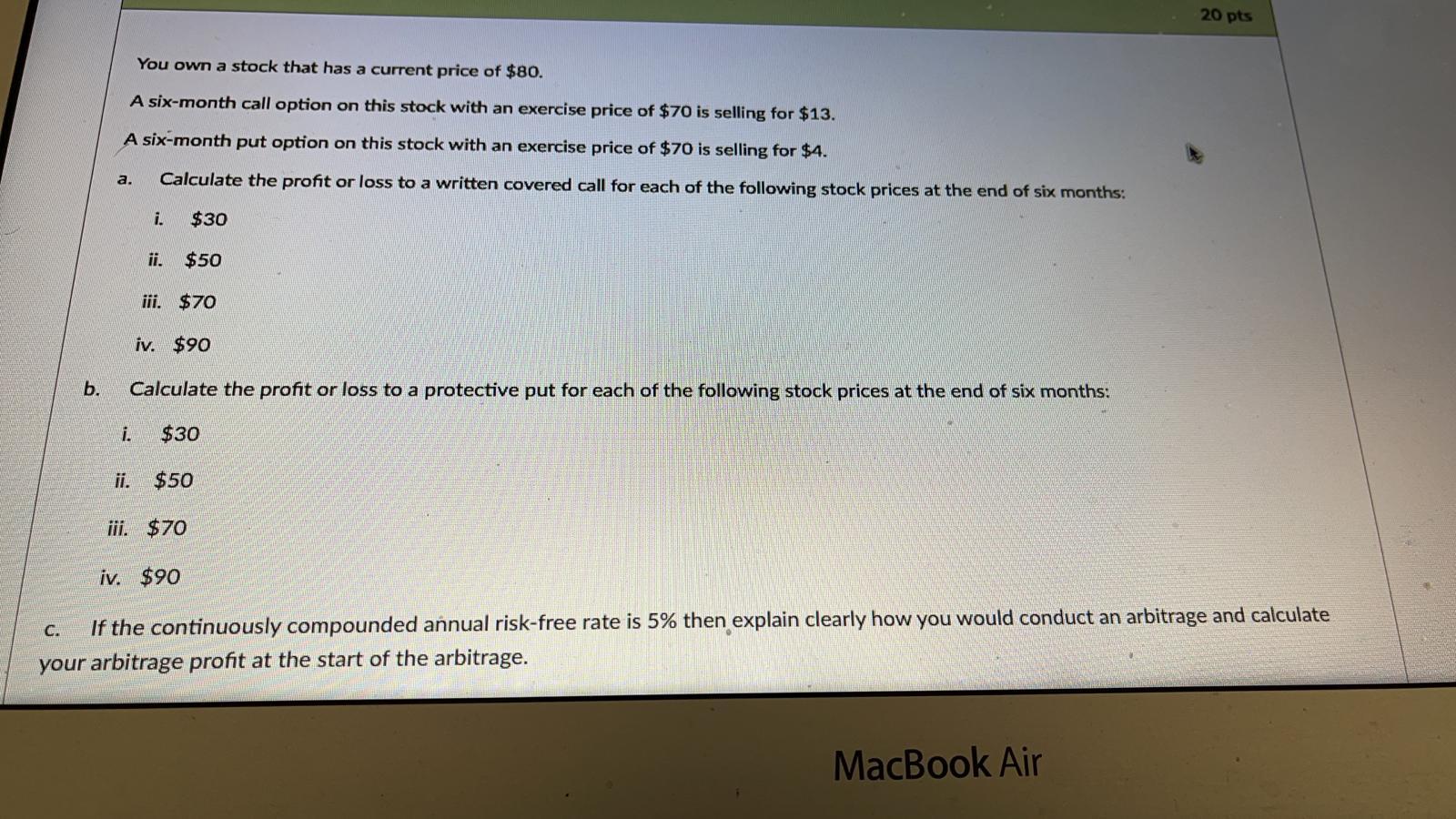

20 pts You own a stock that has a current price of $80. A six-month call option on this stock with an exercise price of $70 is selling for $13. A six-month put option on this stock with an exercise price of $70 is selling for $4. a. Calculate the profit or loss to a written covered call for each of the following stock prices at the end of six months: $30 ii. $50 iii. $70 iv. $90 b. Calculate the profit or loss to a protective put for each of the following stock prices at the end of six months. i. $30 ii. $50 iii. $70 iv. $90 C. If the continuously compounded annual risk-free rate is 5% then explain clearly how you would conduct an arbitrage and calculate your arbitrage profit at the start of the arbitrage. MacBook Air 20 pts You own a stock that has a current price of $80. A six-month call option on this stock with an exercise price of $70 is selling for $13. A six-month put option on this stock with an exercise price of $70 is selling for $4. a. Calculate the profit or loss to a written covered call for each of the following stock prices at the end of six months: $30 ii. $50 iii. $70 iv. $90 b. Calculate the profit or loss to a protective put for each of the following stock prices at the end of six months. i. $30 ii. $50 iii. $70 iv. $90 C. If the continuously compounded annual risk-free rate is 5% then explain clearly how you would conduct an arbitrage and calculate your arbitrage profit at the start of the arbitrage. MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts