Question: Question 20 (1 point) In the single index model, which of the following statements is true? You can diversify away all risk as the number

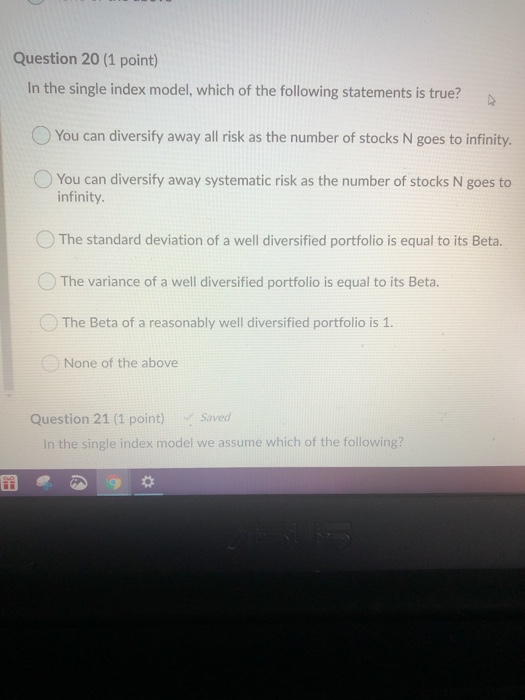

Question 20 (1 point) In the single index model, which of the following statements is true? You can diversify away all risk as the number of stocks N goes to infinity. You can diversify away systematic risk as the number of stocks N goes to infinity The standard deviation of a well diversified portfolio is equal to its Beta. The variance of a well diversified portfolio is equal to its Beta. The Beta of a reasonably well diversified portfolio is 1. None of the above Question 21 (1 point) Saved In the single index model we assume which of the following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts