Question: Question 20 (1 point) Machine X has an upfront cost of $357,000 and annual operating costs of $10,800 over its 4-year life. Machine Y costs

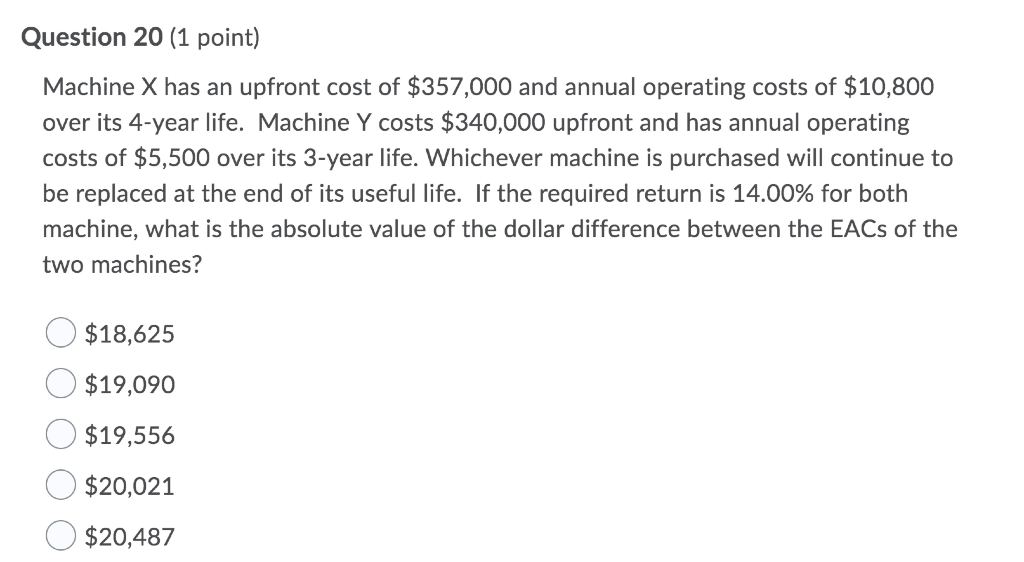

Question 20 (1 point) Machine X has an upfront cost of $357,000 and annual operating costs of $10,800 over its 4-year life. Machine Y costs $340,000 upfront and has annual operating costs of $5,500 over its 3-year life. Whichever machine is purchased will continue to be replaced at the end of its useful life. If the required return is 14.00% for both machine, what is the absolute value of the dollar difference between the EACs of the two machines? $18,625 $19,090 $19,556 $20,021 $20,487

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts