Question: Question 5 (1 point) Machine X has an upfront cost of $372,000 and annual operating costs of $11,250 over its 4-year life. Machine Y costs

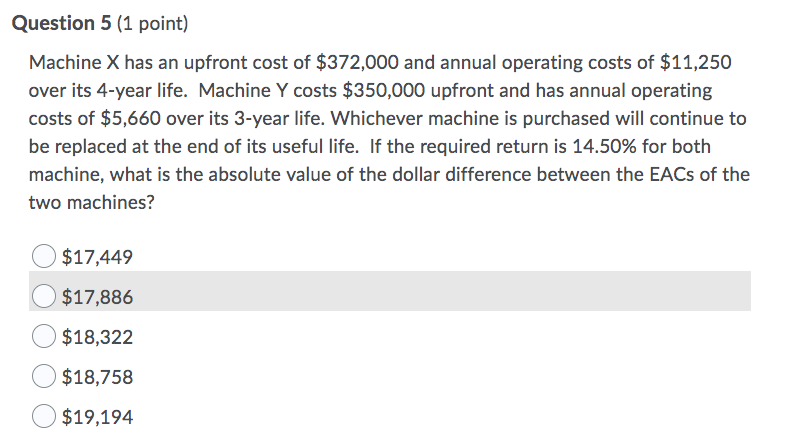

Question 5 (1 point) Machine X has an upfront cost of $372,000 and annual operating costs of $11,250 over its 4-year life. Machine Y costs $350,000 upfront and has annual operating costs of $5,660 over its 3-year life. Whichever machine is purchased will continue to be replaced at the end of its useful life. If the required return is 14.50% for both machine, what is the absolute value of the dollar difference between the EACs of the two machines? $17,449 $17,886 $18,322 $18,758 $19,194

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts