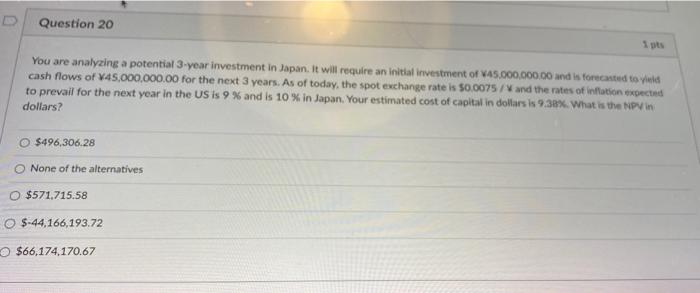

Question: Question 20 1 pts You are analyzing a potential 3-year investment in Japan. It will require an initial investment of V45.000.000.00 and is forecasted to

Question 20 1 pts You are analyzing a potential 3-year investment in Japan. It will require an initial investment of V45.000.000.00 and is forecasted to yield cash flows of V45,000,000.00 for the next 3 years. As of today, the spot exchange rate is $0.0075 / and the rate of inflation expected to prevail for the next year in the US is 9 % and is 10 % in Japan. Your estimated cost of capital in dollars is 9.38% What is the NPV in dollars? O $496,306,28 None of the alternatives O $571.715.58 O $-44,166,193.72 O $66,174,170.67 Question 20 1 pts You are analyzing a potential 3-year investment in Japan. It will require an initial investment of V45.000.000.00 and is forecasted to yield cash flows of V45,000,000.00 for the next 3 years. As of today, the spot exchange rate is $0.0075 / and the rate of inflation expected to prevail for the next year in the US is 9 % and is 10 % in Japan. Your estimated cost of capital in dollars is 9.38% What is the NPV in dollars? O $496,306,28 None of the alternatives O $571.715.58 O $-44,166,193.72 O $66,174,170.67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts