Question: QUESTION 20 10 points Save Antwe Assume there is a bond with a $1,000 par value and 10 percent coupon rate, three years remaining to

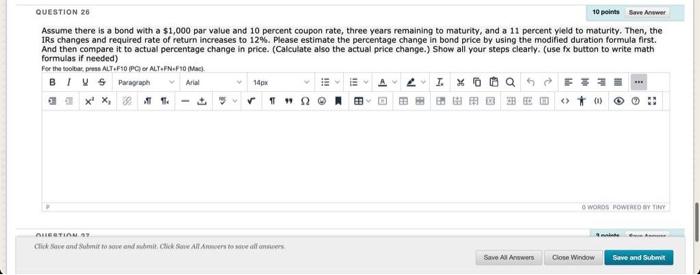

QUESTION 20 10 points Save Antwe Assume there is a bond with a $1,000 par value and 10 percent coupon rate, three years remaining to maturity, and a 11 percent yield to maturity. Then, the IRs changes and required rate of return increases to 12%. Please estimate the percentage change in bond price by using the modified duration formula first. And then compare it to actual percentage change in price. (Calculate also the actual price change.) Show all your steps clearly. (use fx button to write math formulas if needed) For the toolba pre ALT F10 Per ALT.FN.F10 Mac BIVS Payah Aral 140 4 I. XOQ5 12 WORDS POWERED BY TINY ALESTIA Click and Sabit to sow and the Son All Save All Awwers Close Window Save and Sub

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts