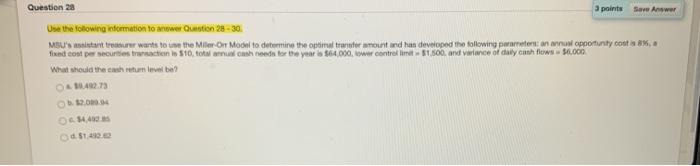

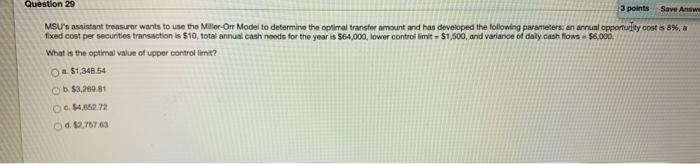

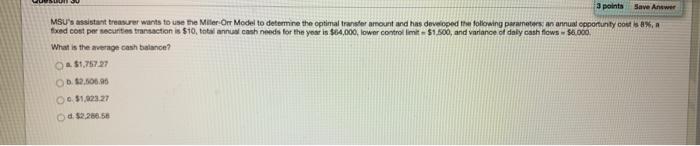

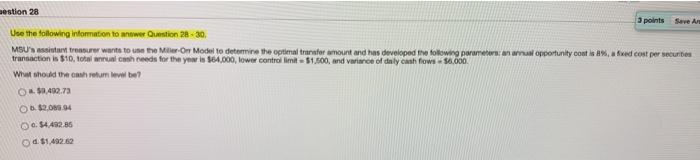

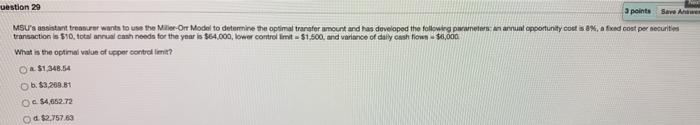

Question: Question 20 3 points Save Answer Use the following information to answer in 28-30 MBU's en treurer wants to in the Miler-Ort Modni to determine

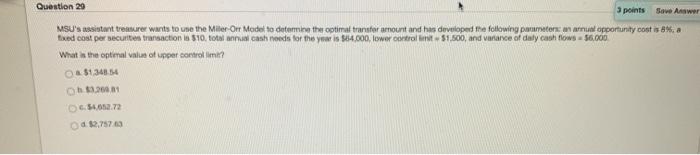

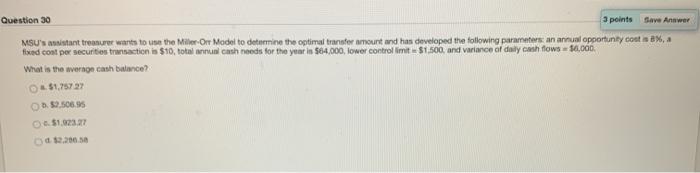

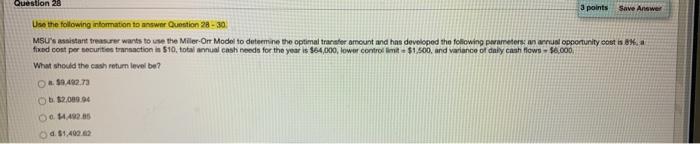

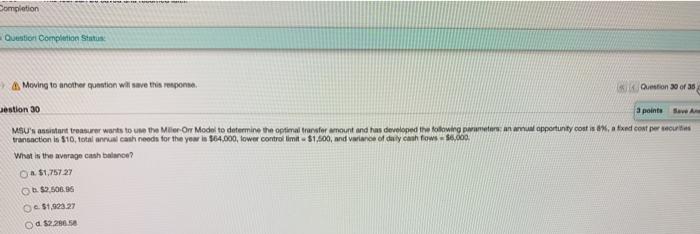

Question 20 3 points Save Answer Use the following information to answer in 28-30 MBU's en treurer wants to in the Miler-Ort Modni to determine the optimal trainer amount and has developed the following parameters on an opponunty cota 86, fixed cost per securities traction in 10 tosh need for the year is 564000, wer control 1.500, and wance of daily canh flows 56.000 What should the cash return vala? 42.73 .. C. 54.40 0.5149 Question 29 3 points Save Answer MSU's assistant trekturer wants to use the Miller Orr Model to determine the optimal transfer amount and has developed the following parameter an annual opportunity.com is a faxed cost per securities transaction is $10 totalul cash needs for the younis 64.000, lower controllit $1.500, and variance of daily cash flows = 56.000 What is the opteral values of upper controllimi? a $1.341.54 3.2001 6.54.612.72 Question 30 3 points Save Answer MSU' istant treurer wants to use the Miller-On Model to determine the optimal transfer amount and has developed the following parameters an annual opportunity costs, fixed cost per securities transaction is $10 total anual cash needs for the year is 564.000, lower controllimit$1.500, and variance of daily cash flows 50.000 What is the average cash balance? $1,7572 1.52.50695 51.82.27 Questlon 28 3 points Save Answer Use the following information to answer Question 28-30 MSU's assistant treasure wants to use the Miller Ort Model to determine the optimal transfer amount and has developed the following parameters an annual opportunity cost is fixed cost per securities transaction is 510, total annual cash needs for the year is $64,000, lower controllimit $1.500, and variance of daily cash flows - $6.000, What should the cash return level be? 58.48273 Ob. 2.000.00 OG HAR 0.61.400.00 Question 29 3 points Save Answ MSU's assistant trensurer wants to use the Miller-Orr Model to determine the optimal transfer amount and has developed the following parameters an arrunt apponuilty costs 8%, a fixed cost per securities transaction is $10 total annual cash needs for the year is 564,000, lower controllimit - $1,500, and variance of daily cash flows $6,000 What is the optimal value of upper controllimit? a $1,348.54 Ob $3,200.81 O S4052.72 d. 52.7676 3 points Save Answer MSU's assistant treasurer wants to use the Miller Orr Model to determine the optimal transfer amount and has developed the following parameters an annual opportunty couts 8%, feed cost per securitie transaction is $10 total annual cash needs for the year is $64,000, lower controllit $1.500, and variance of daly cash flows - 36.000 What is the average cash balance? $1,757.27 OD 2,505 0.51,023.27 estlon 28 3 points Seven Use the following information to answer Question 28-30, MSU's true wants to use the Miller On Model to determine the optimal transfer amount and has developed to following pananampal opportunity cost is 8%, ad cost per securities transaction is $10 totalul cheeds for the year is 164.000, lower controllimit 51.500, and variee of daily cash flows $6.000 What should the shrum evil be? O $9.499.73 6. $2.06.94 6. 54.432.85 0 $1,492.60 Destion 20 3 points Save Awe MSU's assistant treasurer wants to use the Miller-Ort Model to determine the optimal transfer amount and has developed the following pawners an annual opportunity costs 8%, a fixed cost per securities transaction is $10 total anual con noods for the year is $64.000, lower controllimit - $1.500, and variance of daily cash flown * $6,000 What is the optimal value of upper controllimit? O $1,348.54 b. $3,200.1 O $4,652.72 od $2.757.60 Completion Question Completion Status Moving to another gamtion will save the response Question 30 of 35 estion 30 a pointe Svet MSU's antistant treasurer wants to use the Miller-Orr Model to determine the optimal transfer amount and has developed the following parameters an arm apportunty costs*%, a trect cont per curs transaction is $10 total anul cash needs for the yow is $64.000, lower controllimit - $1.500, and variance of daily cash flows - 5.000 What is the average cash balance? O $1.757 27 $9.505.95 e $1.923.27 Od $2.2005

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts