Question: Question 20 (3.03 points) A trader predicts that there are upward price movements of USD/ in the near future, so he decides to construct a

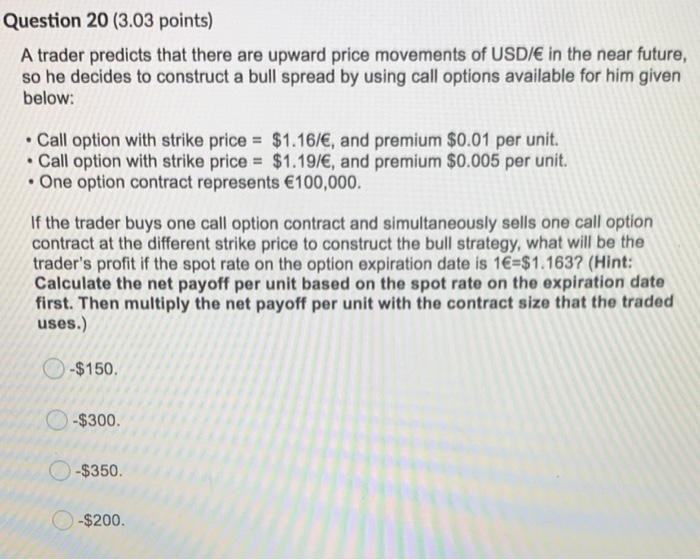

Question 20 (3.03 points) A trader predicts that there are upward price movements of USD/ in the near future, so he decides to construct a bull spread by using call options available for him given below: . Call option with strike price = $1.161, and premium $0.01 per unit. Call option with strike price = $1.19/, and premium $0.005 per unit. One option contract represents 100,000. If the trader buys one call option contract and simultaneously sells one call option contract at the different strike price to construct the bull strategy, what will be the trader's profit if the spot rate on the option expiration date is 1=$1.1637 (Hint: Calculate the net payoff per unit based on the spot rate on the expiration date first. Then multiply the net payoff per unit with the contract size that the traded uses.) -$150. -$300 -$350 -$200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts