Question: Question 2017.5 points) On January 1, current year, Run Co, issued 8-year bonds with a face value of $ 765,000 and a stated interest rate

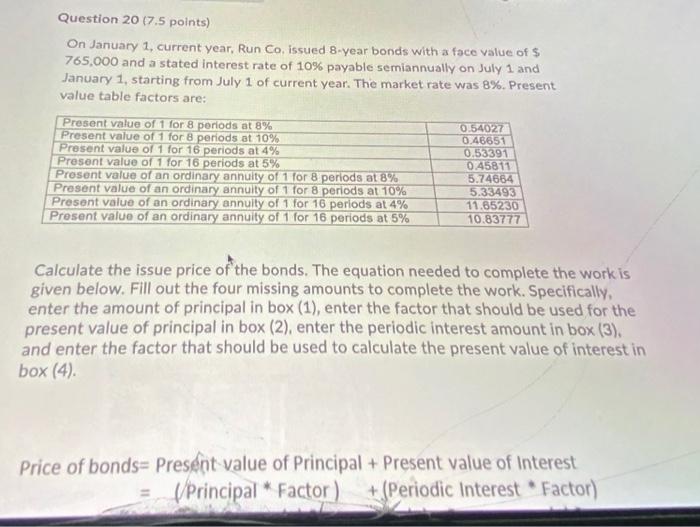

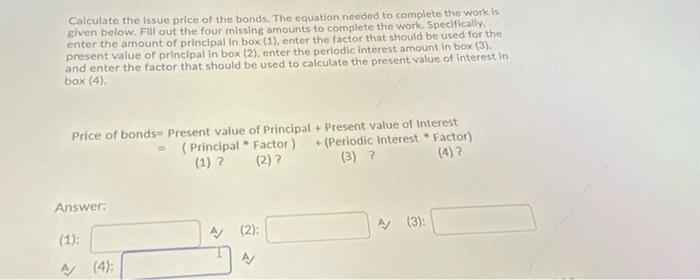

Question 2017.5 points) On January 1, current year, Run Co, issued 8-year bonds with a face value of $ 765,000 and a stated interest rate of 10% payable semiannually on July 1 and January 1, starting from July 1 of current year. The market rate was 8%. Present value table factors are: Present value of 1 for 8 periods at 8% 0.54027 Present value of 1 for 8 periods at 10% 0.46651 Present value of 1 for 16 periods at 4% 0.53391 Present value of 1 for 16 periods at 5% 0,45811 Prosent value of an ordinary annuity of 1 for 8 periods at 8% 5.74664 Present value of an ordinary annuity of 1 for 8 periods at 10% 5.33493 Prosent value of an ordinary annuity of 1 for 16 periods at 4% 11.85230 Present value of an ordinary annuity of 1 for 16 periods at 5% 10.83777 Calculate the issue price of the bonds. The equation needed to complete the work is given below. Fill out the four missing amounts to complete the work. Specifically, enter the amount of principal in box (1), enter the factor that should be used for the present value of principal in box (2), enter the periodic interest amount in box (3). and enter the factor that should be used to calculate the present value of interest in box (4) Price of bonds= Present value of Principal + Present value of Interest (Principal * Factor) +(Periodic Interest Factor) Calculate the issue price of the bonds. The equation needed to complete the work is given below. Fill out the four missing amounts to complete the work. Specifically enter the amount of principal in box (1), enter the factor that should be used for the present value of principal in box (2), enter the periodic interest amount in box (3). and enter the factor that should be used to calculate the present value of Interest in box (4) Price of bonds-Present value of Principal + Present value of interest (Principal Factor) + (Periodic Interest Factor) (1) ? (2) ? (3) ? (4) 2 Answer: A/ (3): A/ (2): (1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts