Question: question 20-24 with steps please IV. Duration, yield to maturity, and the expectation hypothesis 20, what is the duration of a 7-year bond with an

question 20-24 with steps please

question 20-24 with steps please

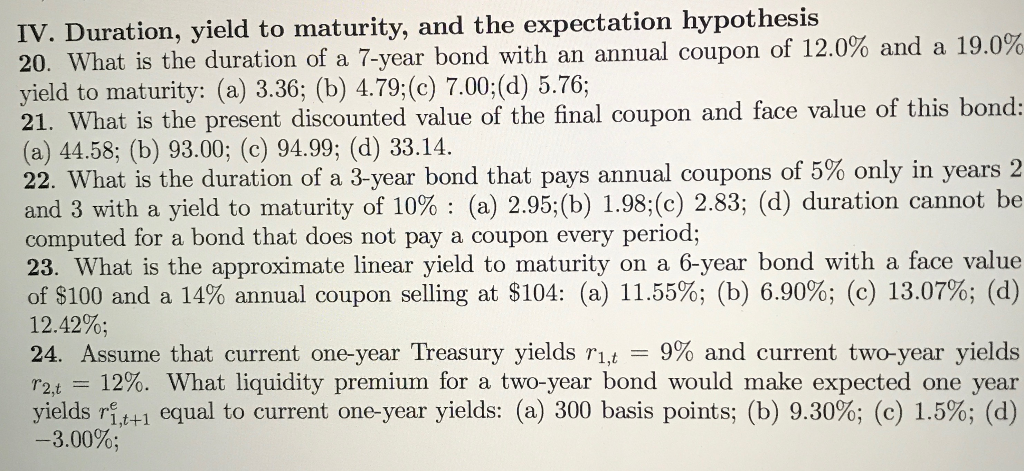

IV. Duration, yield to maturity, and the expectation hypothesis 20, what is the duration of a 7-year bond with an annual coupon of 12.0% and a 19.0 yield to maturity: (a) 3.36; (b) 4.79;(c) 7.00;(d) 5.76; 21. What is the present discounted value of the final coupon and face value of this bonds (a) 44.58; (b) 93.00; (c) 94.99; (d) 33.14 22, What is the duration of a 3-year bond that pays annual coupons of 5% only in years 2 and 3 with a yield to maturity of 10% : (a) 2.95,(b) 1.98(c) 283; (d) duration cannot be computed for a bond that does not pay a coupon every period; 23. What is the approximate linear yield to maturity on a 6-year bond with a face value of $100 and a 14% annual coupon selling at $104: (a) 11.55%; (b) 6.90%; (c) 13.07%; (d) 12.42%; 24. Assume that current one-year Treasury yields r1,t 9% and current two-year yields r2,-12%. What liquidity premium for a two-year bond would make expected one year yields retti equal to current one-year yields: (a) 300 basis points. (b) 9.30%; (c) 1.5%; (d) -3.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts