Question: QUESTION 21 (10 points) - Inventory Turns and Inventory Costs We are comparing The Home Depot, Inc. and Lowe's Companies, Inc., the two giant retailers

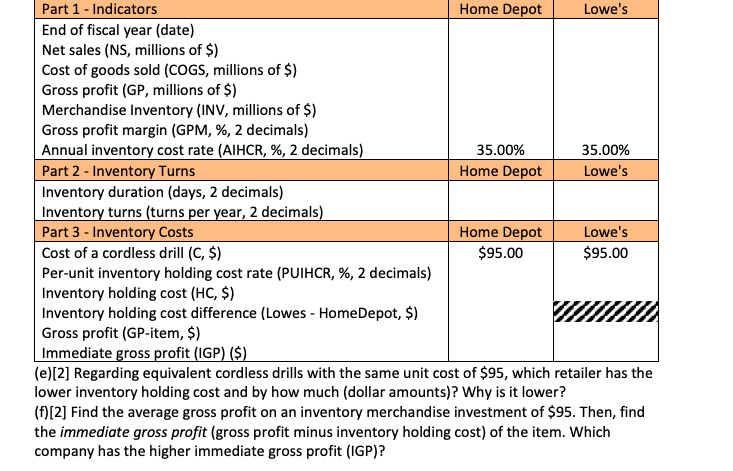

QUESTION 21 (10 points) - Inventory Turns and Inventory Costs We are comparing The Home Depot, Inc. and Lowe's Companies, Inc., the two giant retailers in home & construction products and services, regarding their inventory turns and inventory costs. (a)[2] You need to find official corporate data for 2021 to fill in Part 1 of the table below. Specifically, you need to locate the 10-K fillings or annual reports on: - The Home Depot, Inc.: https://ir.homedepot.com/ - Lowe's Companies, Inc.: https://corporate.lowes.com/investors Assume that price and inventory turns are independent of each other; and there are 365 days of operations in a year. In addition, the annual inventory holding cost rate is provided in the table. For Part 2 and Part 3, show equations and calculations, and complete the table below. 1 (b)[2] What is the average number of days that a product typically stays in the two companies' inventories until sold (days of supply or inventory duration)? (2 decimals) (c)[1] What are the inventory turns per year at these two retailers? (2 decimals) (d)[1] What are the per-unit inventory cost rates at the two companies? (%, 2 decimals) Part 1 - Indicators Home Depot Lowe's End of fiscal year (date) Net sales (NS, millions of $) Cost of goods sold (COGS, millions of $) Gross profit (GP, millions of $) Merchandise Inventory (INV, millions of $) Gross profit margin (GPM, %, 2 decimals) Annual inventory cost rate (AIHCR, %, 2 decimals) 35.00% 35.00% Part 2 - Inventory Turns Home Depot Lowe's Inventory duration (days, 2 decimals) Inventory turns (turns per year, 2 decimals) Part 3 - Inventory Costs Home Depot Lowe's Cost of a cordless drill (C, $) $95.00 $95.00 Per-unit inventory holding cost rate (PUIHCR, %, 2 decimals) Inventory holding cost (HC, $) Inventory holding cost difference (Lowes - HomeDepot, $) Gross profit (GP-item, $) Immediate gross profit (IGP) ($) (e)[2] Regarding equivalent cordless drills with the same unit cost of $95, which retailer has the lower inventory holding cost and by how much (dollar amounts)? Why is it lower? (f)[2] Find the average gross profit on an inventory merchandise investment of $95. Then, find the immediate gross profit (gross profit minus inventory holding cost) of the item. Which company has the higher immediate gross profit (IGP)?

Can someone please help me with this problem? I am having trouble understanding how to do it. The links for the fiscal 10k form are in the problem. Thank you!!

QUESTION 21 (10 points) - Inventory Turns and Inventory Costs We are comparing The Home Depot, Inc. and Lowe's Companies, Inc., the two giant retailers in home \& construction products and services, regarding their inventory turns and inventory costs. (a)[2] You need to find official corporate data for 2021 to fill in Part 1 of the table below. Specifically, you need to locate the 10K fillings or annual reports on: - The Home Depot, Inc.: https://ir.homedepot.com/ - Lowe's Companies, Inc.: https://corporate.lowes.com/investors Assume that price and inventory turns are independent of each other; and there are 365 days of operations in a year. In addition, the annual inventory holding cost rate is provided in the table. For Part 2 and Part 3, show equations and calculations, and complete the table below. 1 (b)[2] What is the average number of days that a product typically stays in the two companies' inventories until sold (days of supply or inventory duration)? (2 decimals) (c) [1] What are the inventory turns per year at these two retailers? (2 decimals) (d) [1] What are the per-unit inventory cost rates at the two companies? (\%, 2 decimals) \begin{tabular}{|l|c|c|} \hline Part 1 - Indicators & Home Depot & Lowe's \\ \hline End of fiscal year (date) & & \\ Net sales (NS, millions of \$) & & \\ Cost of goods sold (COGS, millions of \$) & & \\ Gross profit (GP, millions of \$) & & \\ Merchandise Inventory (INV, millions of \$) & & \\ Gross profit margin (GPM, \%, 2 decimals) Annual inventory cost rate (AIHCR, \%, 2 decimals) & Lowe's \\ \hline Part 2 - Inventory Turns & Home Depot & \\ \hline Inventory duration (days, 2 decimals) Inventory turns (turns per year, 2 decimals) & & \\ \hline Part 3 - Inventory Costs & & Lowe's \\ \hline Cost of a cordless drill (C, \$) Per-unit inventory holding cost rate (PUIHCR, \%, 2 decimals) Inventory holding cost (HC, \$) Inventory holding cost difference (Lowes - HomeDepot, \$) Gross profit (GP-item, \$) Immediate gross profit (IGP) (\$) & & \\ \hline \end{tabular} (e)[2] Regarding equivalent cordless drills with the same unit cost of \$95, which retailer has the lower inventory holding cost and by how much (dollar amounts)? Why is it lower? (f) [2] Find the average gross profit on an inventory merchandise investment of $95. Then, find the immediate gross profit (gross profit minus inventory holding cost) of the item. Which company has the higher immediate gross profit (IGP)Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts