Question: Question #21 / Decision Tree Analysis . IUGIIC 01 LVVU. 11 0111 YUI IU PUIGIJU highest expected payoff? 21. The owner of Pearl Automotive Dealers

Question #21 / Decision Tree Analysis

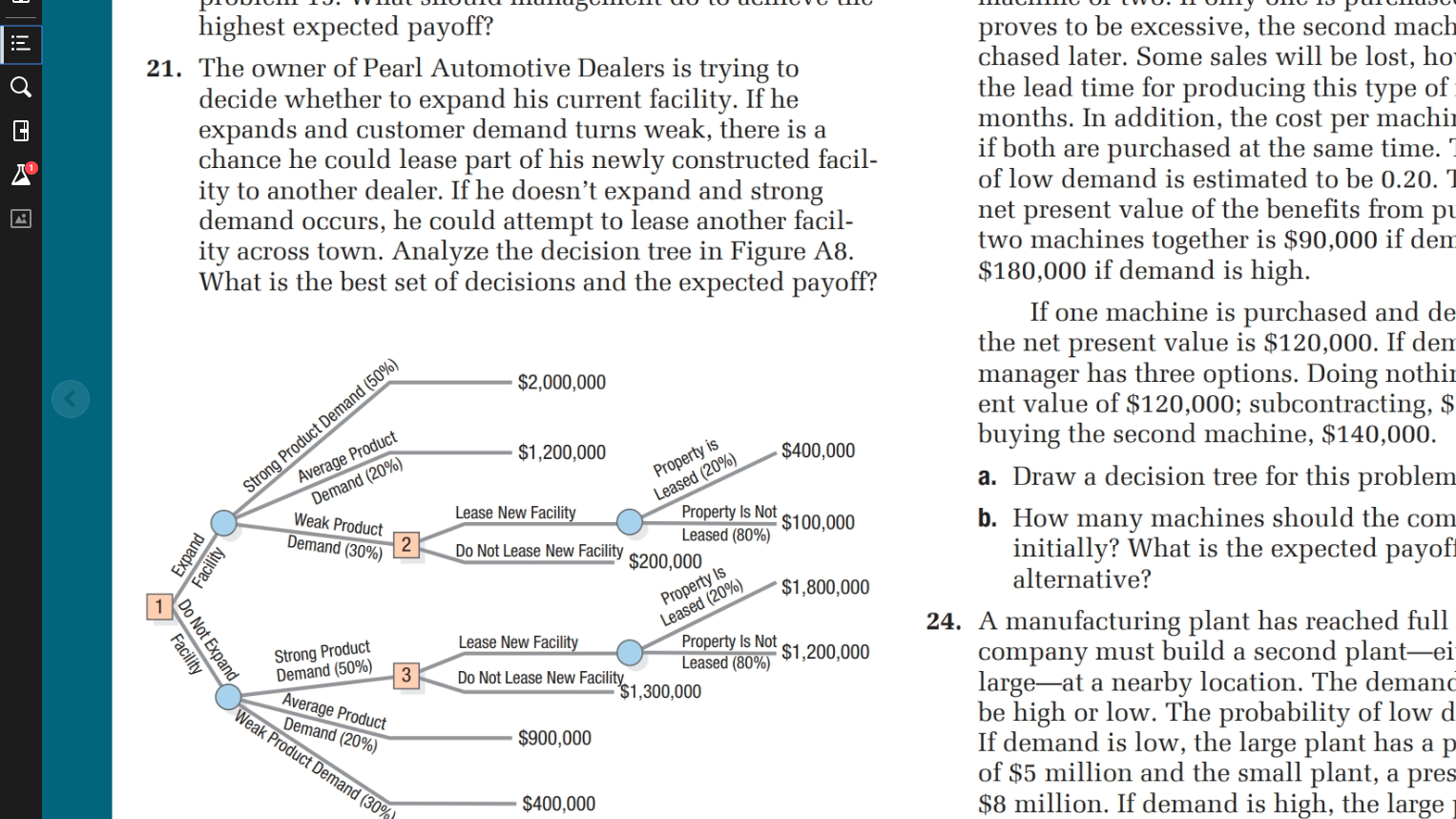

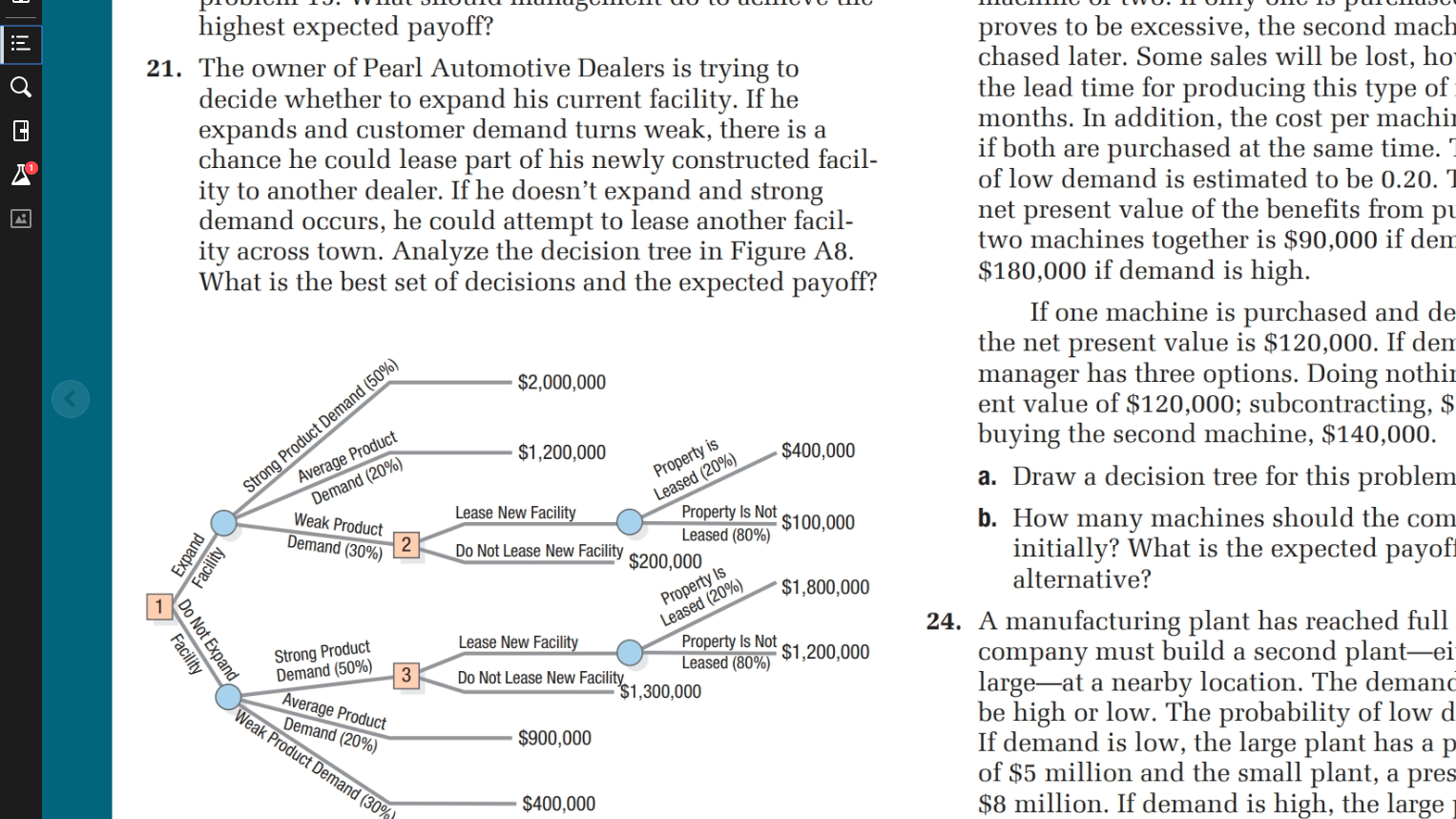

. IUGIIC 01 LVVU. 11 0111 YUI IU PUIGIJU highest expected payoff? 21. The owner of Pearl Automotive Dealers is trying to decide whether to expand his current facility. If he expands and customer demand turns weak, there is a chance he could lease part of his newly constructed facil- ity to another dealer. If he doesn't expand and strong demand occurs, he could attempt to lease another facil- ity across town. Analyze the decision tree in Figure A8. What is the best set of decisions and the expected payoff? $2,000,000 proves to be excessive, the second mach chased later. Some sales will be lost, ho the lead time for producing this type of months. In addition, the cost per machin if both are purchased at the same time. I of low demand is estimated to be 0.20. 1 net present value of the benefits from pu two machines together is $90,000 if dem $180,000 if demand is high. If one machine is purchased and de the net present value is $120,000. If dem manager has three options. Doing nothi ent value of $120.000: subcontracting, $ buying the second machine, $140,000. a. Draw a decision tree for this problem b. How many machines should the com initially? What is the expected payoft alternative? 24. A manufacturing plant has reached full company must build a second plant-ei largeat a nearby location. The demand be high or low. The probability of low d If demand is low, the large plant has a p of $5 million and the small plant, a pres $8 million. If demand is high, the large $1,200,000 20%) $400,000 Strong Product Demand (50%) Average Product Demand (20%) Property is Leased (20%) Weak Product Property Is Not $100,000 Expand Facility Demand (30%) 2 Lease New Facility Leased (80%) Do Not Lease New Facility $200.000 $1,800,000 Property is Leased (20%) Lease New Facility Property is VOL 1 200 000 Facility Do Not Expand Strong Product Demand (50%) Not Lease New Facilitys 1.300.000 Leased (80%) $1,200,000 Weak Product Demand (30% Average Product Demand (20%) $900,000 $400,000