Question: QUESTION 21 Replacement Project A Firm is considering the Replacement of the Existing Equipment. The Firm's Marginal Tax Rate is 40%. The Old Equipment was

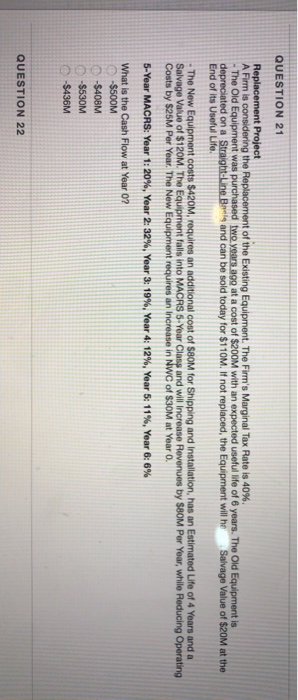

QUESTION 21 Replacement Project A Firm is considering the Replacement of the Existing Equipment. The Firm's Marginal Tax Rate is 40%. The Old Equipment was purchased two years ago at a cost of $200M with an expected useful life of 6 years. The Old Equipment is depreciated on a Straight-Line Bar and can be sold today for $110M. If not replaced, the Equipment will he Salvage Value of $20M at the End of its Useful Life. - The New Equipment costs $420M, requires an additional cost of S8OM for Shipping and Installation, has an Estimated Life of 4 Years and a Salvage Value of $120M. The Equipment falls into MACRS 5-Year Class and will increase Revenues by S8OM Por Yoar, while Reducing Operating Costs by $25M Per Year. The New Equipment requires an increase in NWC of $30M at Year O. 5-Year MACRS: Year 1: 20%, Year 2:32%, Year 3: 19%, Year 4:12%, Year 5: 11%, Year 6:6% What is the Cash Flow at Year 0? -$500M -5408M -$530M -$436M QUESTION 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts