Question: QUESTION 21 Wilson's Market is considering two mutually exclusive projects that will not be repeated. The required rate of return is 13.9% per annum for

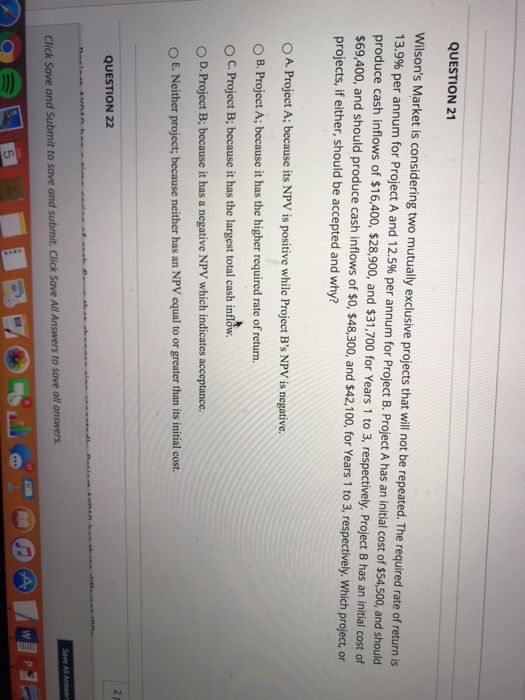

QUESTION 21 Wilson's Market is considering two mutually exclusive projects that will not be repeated. The required rate of return is 13.9% per annum for Project A and 12.5% per annum for Project B. Project A has an initial cost of $54,500, and should produce cash inflows of $16,400, $28,900, and $31,700 for Years 1 to 3, respectively. Project B has an initial cost of $69,400, and should produce cash inflows of $0, $48,300, and $42,100, for Years 1 to 3, respectively. Which project, or projects, if either, should be accepted and why? A. Project A; because its NPV is positive while Project B's NPV is negative. B. Project A; because it has the higher required rate of return. OC. Project B; because it has the largest total ash inflow. OD. Project B; because it has a negative NPV which indicates acceptance. OE. Neither project; because neither has an NPV equal to or greater than its initial cost. 2 QUESTION 22 Save Al Answer Click Save and Submit to save and submit. Click Save All Answers to save all answers. w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts