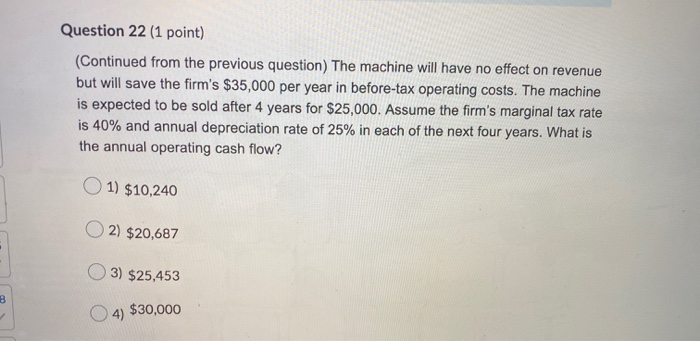

Question: Question 22 (1 point) (Continued from the previous question) The machine will have no effect on revenue but will save the firm's $35,000 per year

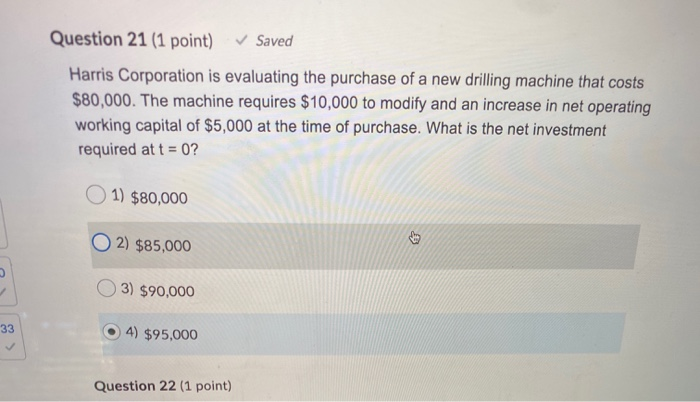

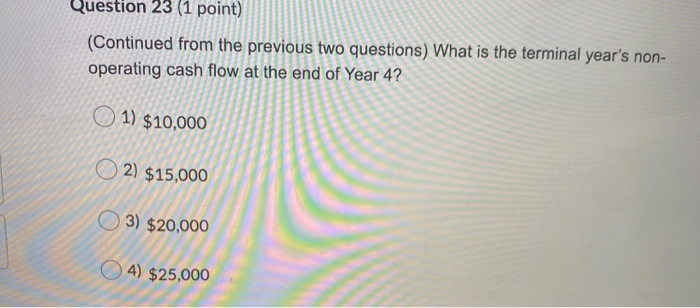

Question 22 (1 point) (Continued from the previous question) The machine will have no effect on revenue but will save the firm's $35,000 per year in before-tax operating costs. The machine is expected to be sold after 4 years for $25,000. Assume the firm's marginal tax rate is 40% and annual depreciation rate of 25% in each of the next four years. What is the annual operating cash flow? 1) $10,240 O2) $20,687 3) $25,453 4) $30,000 Question 21 (1 point) Saved Harris Corporation is evaluating the purchase of a new drilling machine that costs $80,000. The machine requires $10,000 to modify and an increase in net operating working capital of $5,000 at the time of purchase. What is the net investment required at t = 0? 1) $80,000 O2) $85,000 3) $90,000 4) $95,000 Question 22 (1 point) Question 23 (1 point) (Continued from the previous two questions) What is the terminal year's non- operating cash flow at the end of Year 4? O 1) $10,000 2) $15,000 O3) $20,000 4) $25,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts