Question: Question 22 (1 point) In the single index model we assume which of the following? The higher a stock's standard deviation, the higher its expected

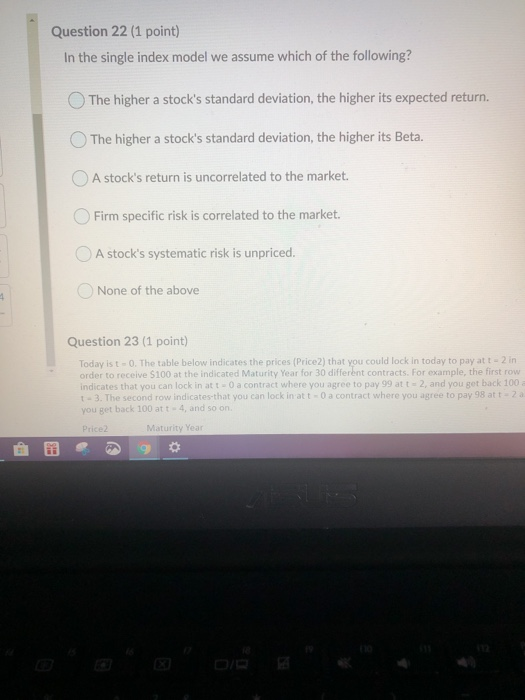

Question 22 (1 point) In the single index model we assume which of the following? The higher a stock's standard deviation, the higher its expected return. The higher a stock's standard deviation, the higher its Beta. A stock's return is uncorrelated to the market. Firm specific risk is correlated to the market. A stock's systematic risk is unpriced. None of the above 4 Question 23 (1 point) Today is to. The table below indicates the prices (Price2) that you could lock in today to pay at t - 2 in order to receive $100 at the indicated Maturity Year for 30 different contracts. For example, the first row indicates that you can lock in atto a contract where you agree to pay 99 at t = 2, and you get back 100 a 1 - 3. The second row indicates that you can lock in atto a contract where you agree to pay 98 att 2 a you get back 100 att - 4, and so on. Price2 Maturity Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts