Question: Question 22 1 points Save Answer You are a currency arbitrageur with $1,000,000 (or the euro-equivalent amount) available to borrow for one year. You arrive

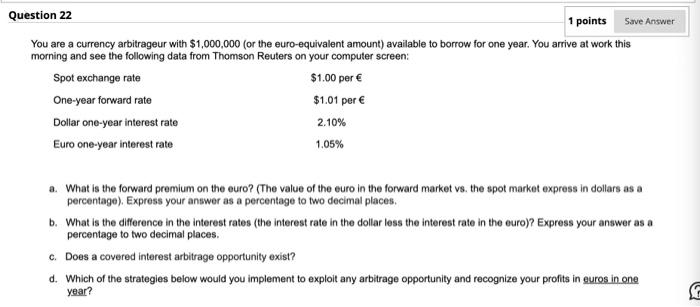

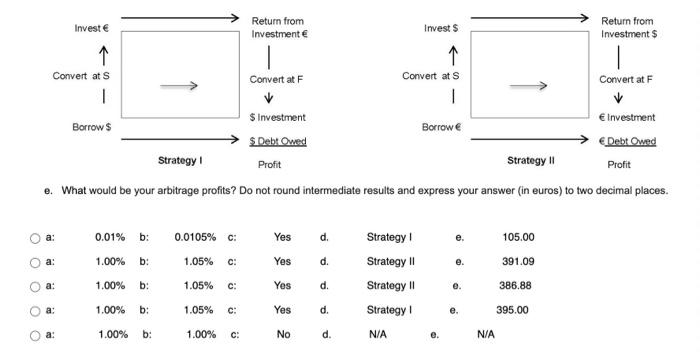

Question 22 1 points Save Answer You are a currency arbitrageur with $1,000,000 (or the euro-equivalent amount) available to borrow for one year. You arrive at work this morning and see the following data from Thomson Reuters on your computer screen: Spot exchange rate $1.00 per One-year forward rate $1.01 per Dollar one-year interest rate 2.10% Euro one-year interest rate 1.05% a What is the forward premium on the euro? (The value of the euro in the forward market vs. the spot market express in dollars as a percentage). Express your answer as a percentage to two decimal places. b. What is the difference in the interest rates (the interest rate in the dollar less the interest rate in the euro)? Express your answer as a percentage to two decimal places. c. Does a covered interest arbitrage opportunity exist? d. Which of the strategies below would you implement to exploit any arbitrage opportunity and recognize your profits in euros in one year? Return from Investment $ Invest Return from Investment Invest 1 Convert ats Convert at F Convert at s Convert at F 1 1 Borrows S Investment Investment Borrowe $ Debt Owed Debt Owed Strategy Profit Strategy Profit e. What would be your arbitrage profits? Do not round intermediate results and express your answer in euros) to two decimal places. a: 0.01% b: 0.0105% c: Yes d. 105.00 o o a: 1.00% b: 1.05% C: Yes d. e. 391.09 a: 1.00% b: 1.05% C: c: Yes d. Strategy Strategy 11 Strategy | Strategy N/A e. 386.88 a: 1.00% b: 1.05% c: Yes d. e. 395.00 OO a: 1.00% b: 1.00% c: No d. e. N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts