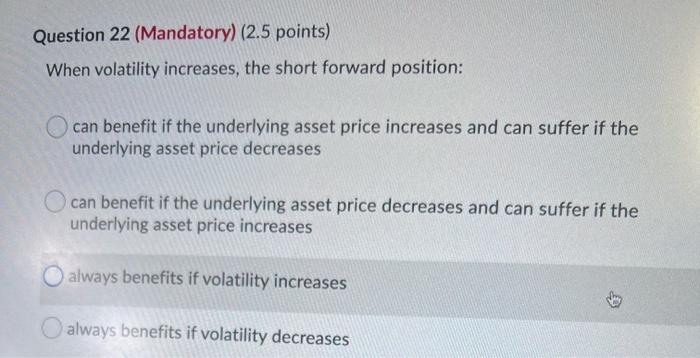

Question: Question 22 (Mandatory) (2.5 points) When volatility increases, the short forward position: can benefit if the underlying asset price increases and can suffer if the

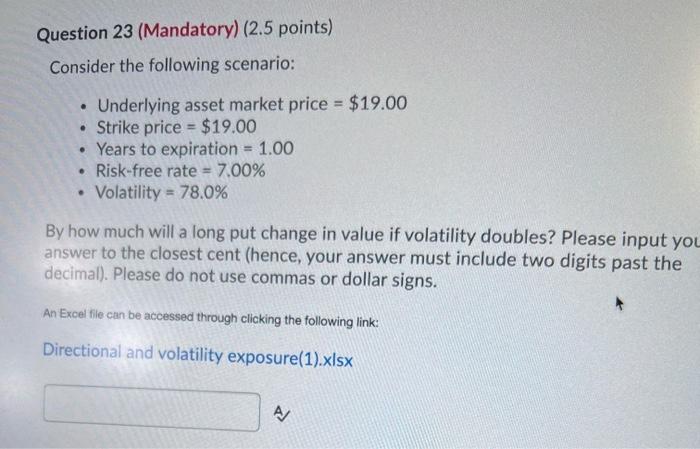

Question 22 (Mandatory) (2.5 points) When volatility increases, the short forward position: can benefit if the underlying asset price increases and can suffer if the underlying asset price decreases can benefit if the underlying asset price decreases and can suffer if the underlying asset price increases always benefits if volatility increases always benefits if volatility decreases Question 23 (Mandatory) (2.5 points) Consider the following scenario: Underlying asset market price = $19.00 Strike price = $19.00 Years to expiration = 1.00 Risk-free rate = 7.00% Volatility = 78.0% . By how much will a long put change in value if volatility doubles? Please input you answer to the closest cent (hence, your answer must include two digits past the decimal). Please do not use commas or dollar signs. An Excel file can be accessed through clicking the following link: Directional and volatility exposure(1).xlsx A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts