Question: please answer the 2 questions below: Question 33 (Mandatory) (2.5 points) When volatility increases, the short forward position: can benefit if the underlying asset price

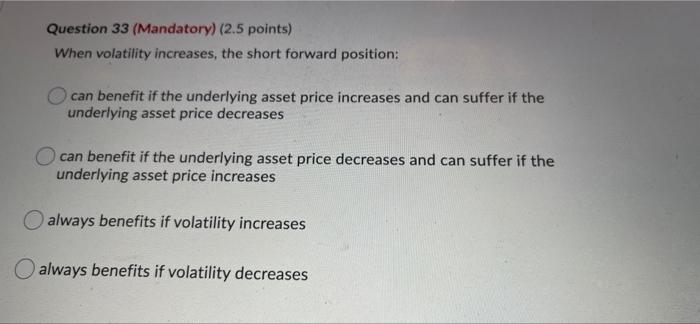

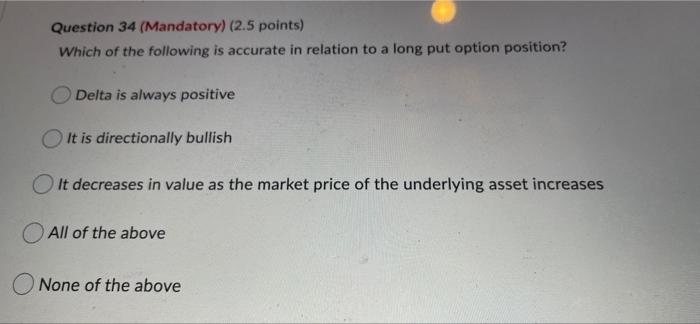

Question 33 (Mandatory) (2.5 points) When volatility increases, the short forward position: can benefit if the underlying asset price increases and can suffer if the underlying asset price decreases can benefit if the underlying asset price decreases and can suffer if the underlying asset price increases always benefits if volatility increases always benefits if volatility decreases Question 34 (Mandatory) (2.5 points) Which of the following is accurate in relation to a long put option position? Delta is always positive It is directionally bullish Olt decreases in value as the market price of the underlying asset increases All of the above None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts