Question: QUESTION 22 Ossa Ltd has determined its optimal capital structure, which is composed cof the following sources and target value proportions: Source of capital Long

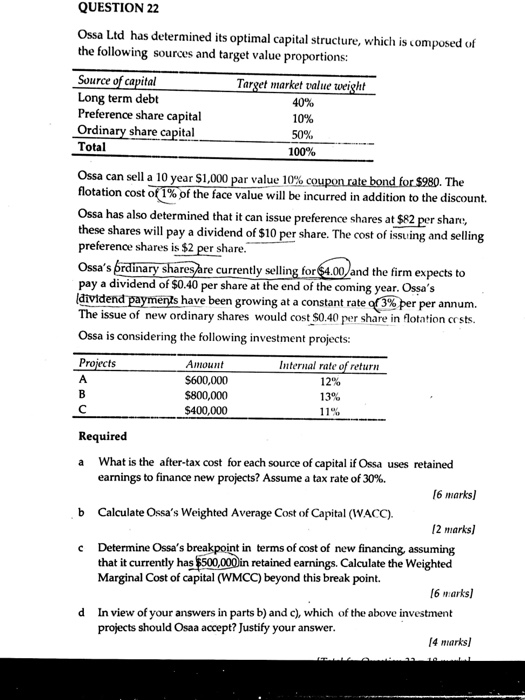

QUESTION 22 Ossa Ltd has determined its optimal capital structure, which is composed cof the following sources and target value proportions: Source of capital Long term debt Preference share capital Ordinary share capital Total Target market value weight 40% 10% 50% 100% Ossa can sell a 10 year $1,000 par value 10% coupon ratebondfor$980. flotation cost of 1% of the face value will be incurred in addition to the discount. also determined that it can issue preference shares at $82 per sharv:, these shares will pay a dividend of $10 per share. The cost of issuing and selling preference shares is $2 per share Ossa's prdi pay a dividend of $0.40 per share at the end of the coming year. Ossa's dividend paymentshave been growing at a constant rate(5% per per annum. The issue of new ordinary shares would cost S0.40 per share in flotation crsts. Ossa is considering the following investment projects: Pro nar re currently selling for $4.00 and the firm expects to Amount S600,000 $800,000 $400,000 Internal rate of return 12% 13% 11% Required a What is the after-tax cost for each source of capital if Ossa uses retained earnings to finance new projects? Assume a tax rate of 30%. Calculate Ossa's Weighted Average Cost of Capital (IVACC). that it currently has $500,000in retained earnings. Calculate the Weighted 6 marks] b (2 marks c Determine Ossa's breakpoint in terms of cost of new financing, assuming Marginal Cost of capital (WMCC) beyond this break point. (6 marksl d In view of your answers in parts b) and c), which of the above investment projects should Osaa accept? Justify your answer 4 marksl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts