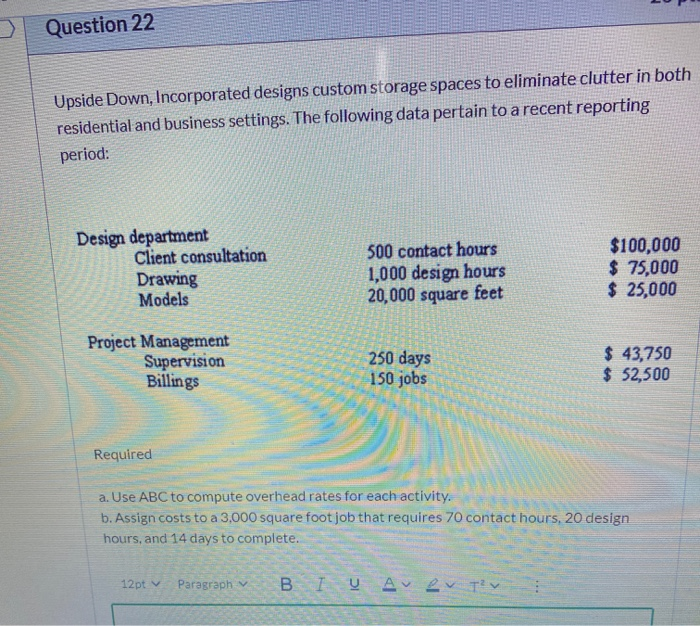

Question: Question 22 Upside Down, Incorporated designs custom storage spaces to eliminate clutter in both residential and business settings. The following data pertain to a recent

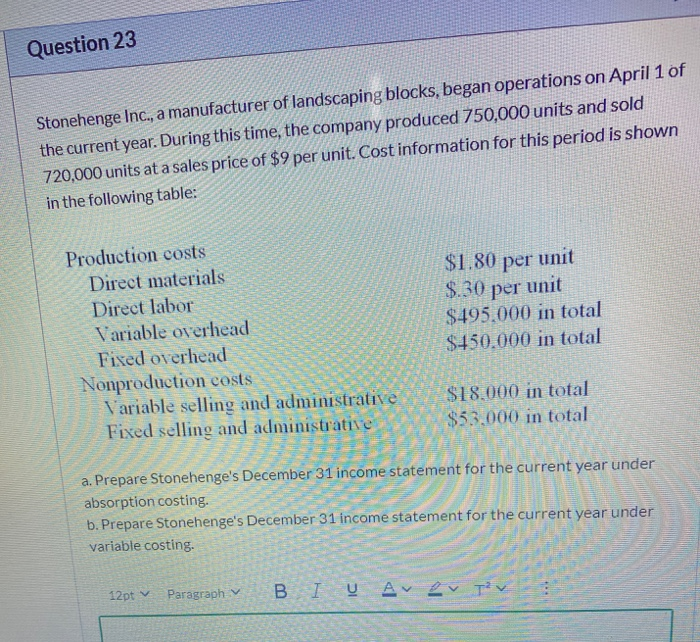

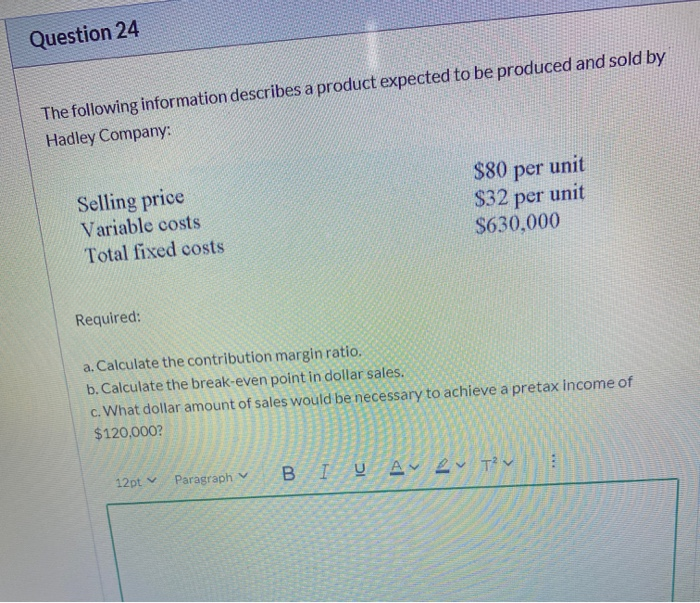

Question 22 Upside Down, Incorporated designs custom storage spaces to eliminate clutter in both residential and business settings. The following data pertain to a recent reporting period: Design department Client consultation Drawing Models 500 contact hours 1,000 design hours 20,000 square feet $100,000 $ 75,000 $ 25,000 Project Management Supervision Billings 250 days 150 jobs $ 43,750 $ 52,500 Required a. Use ABC to compute overhead rates for each activity. b. Assign costs to a 3,000 square footjob that requires 70 contact hours, 20 design hours, and 14 days to complete. 12pt Paragraph B 1 VA 2 Tv Question 23 Stonehenge Inc., a manufacturer of landscaping blocks, began operations on April 1 of the current year. During this time, the company produced 750,000 units and sold 720,000 units at a sales price of $9 per unit. Cost information for this period is shown in the following table: Production costs Direct materials Direct labor Variable overhead Fixed overhead Nonproduction costs Variable selling and administrative Fixed selling and administrative $1.80 per unit $.30 per unit $495.000 in total $450,000 in total $18.000 in total $53.000 in total a. Prepare Stonehenge's December 31 income statement for the current year under absorption costing. b. Prepare Stonehenge's December 31 income statement for the current year under variable costing. 12pt Paragraph B IV Ave Tv Question 24 The following information describes a product expected to be produced and sold by Hadley Company: $80 per unit unit $630,000 Selling price Variable costs Total fixed costs $32 per Required: a. Calculate the contribution margin ratio. b. Calculate the break-even point in dollar sales. c. What dollar amount of sales would be necessary to achieve a pretax income of $120,000? 12pt Paragraph B I VA 2 Tv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts