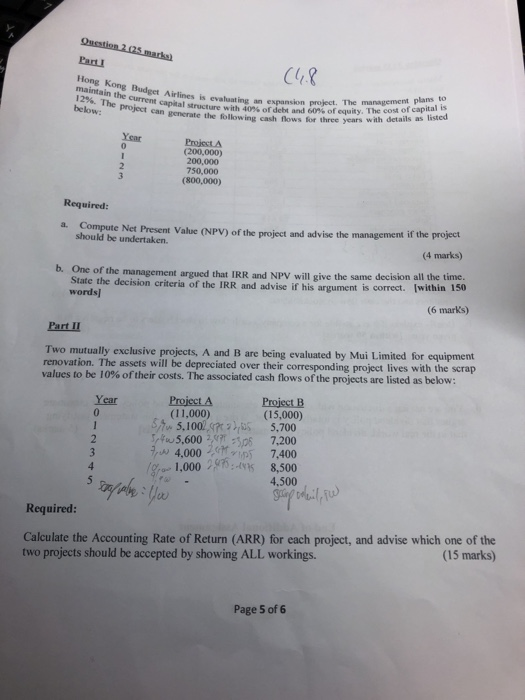

Question: Question 2.25 marka) Part 1 (4.8 maintain the current capital structure with 40 ordebt and 60% of equity. The cost of capital is 129. The

Question 2.25 marka) Part 1 (4.8 maintain the current capital structure with 40 ordebt and 60% of equity. The cost of capital is 129. The project can generate the following cash flows for three years with details as listed Year 0 1 2 3 Project (200,000) 200,000 750,000 (800,000) Required: a. Compute Net Present Value (NPV) of the project and advise the management if the project should be undertaken. (4 marks) b. One of the management argued that IRR and NPV will give the same decision all the time. State the decision criteria of the IRR and advise if his argument is correct. [within 150 words) (6 marks) Part II Two mutually exclusive projects, A and B are being evaluated by Mui Limited for equipment renovation. The assets will be depreciated over their corresponding project lives with the scrap values to be 10% of their costs. The associated cash flows of the projects are listed as below: Year 0 2 3 4 5 Project A Project B (11,000) (15,000) 5:4w 5.100247 3,625 5.700 stw 5.600 23.5 7,200 7w 4,000 7,400 19 - 1,000 23:15 8,500 4.500 goop oodail, so saapple you Required: Calculate the Accounting Rate of Return (ARR) for each project, and advise which one of the two projects should be accepted by showing ALL workings. (15 marks) Page 5 of 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts