Question: Question 23 (1 point) A proposed project lasts three years and has an initial investment of $200,000. The after-tax cash flows are estimated at $64,960

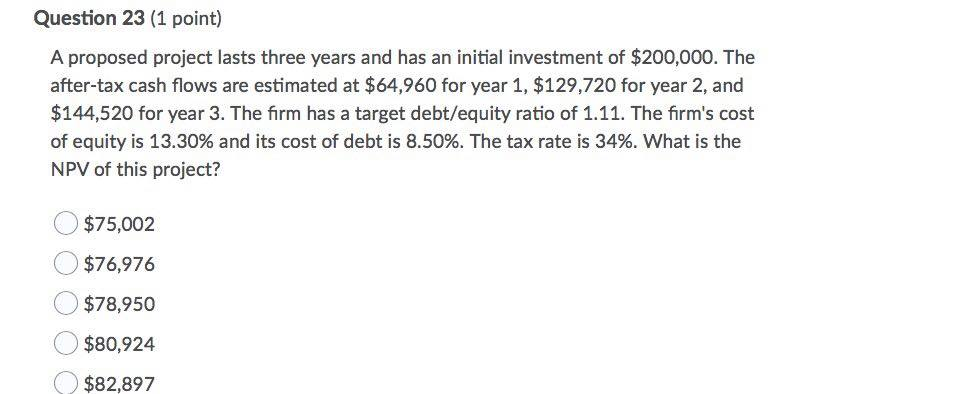

Question 23 (1 point) A proposed project lasts three years and has an initial investment of $200,000. The after-tax cash flows are estimated at $64,960 for year 1, $129,720 for year 2, and $144,520 for year 3. The firm has a target debt/equity ratio of 1.11. The firm's cost of equity is 13.30% and its cost of debt is 8.50%. The tax rate is 34%. What is the NPV of this project? $75,002 $76,976 $78,950 $80,924 $82,897

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts