Question: A proposed project lasts three years and has an initial investment of $200,000. The after-tax cash flows are estimated at $84,980 for year 1, $169,200

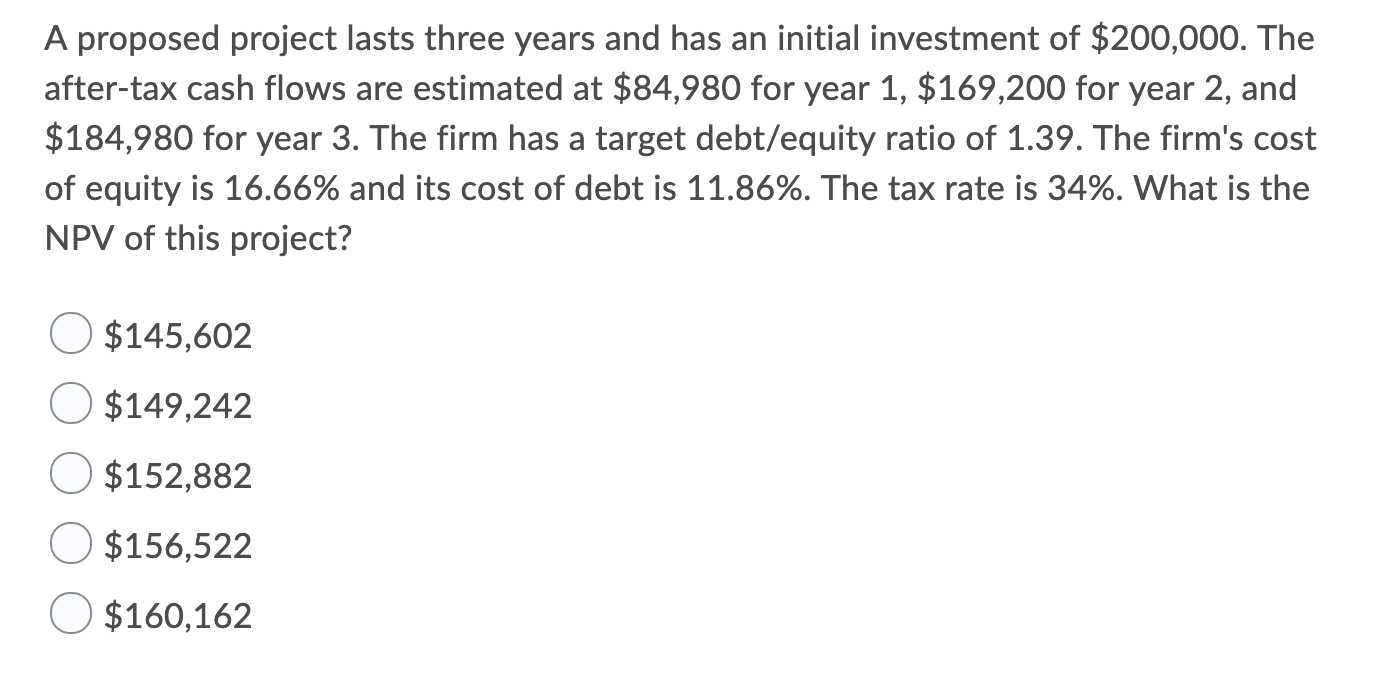

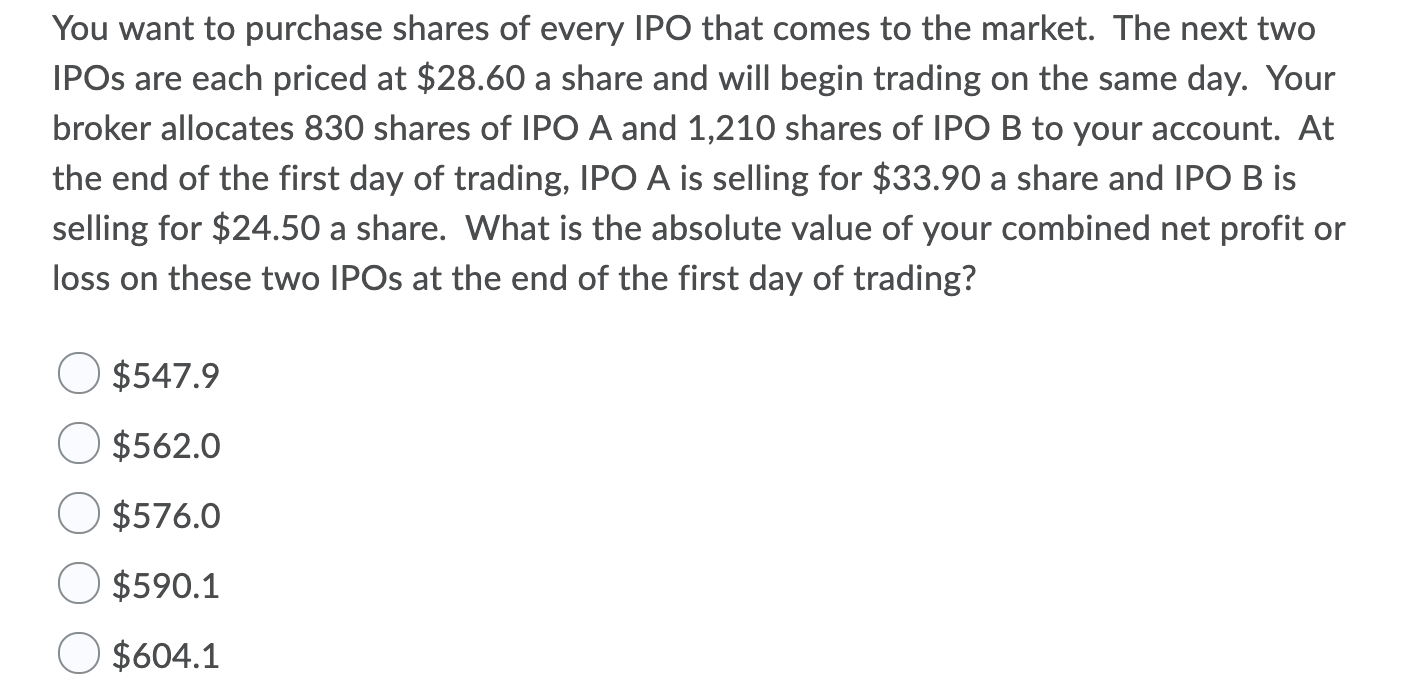

A proposed project lasts three years and has an initial investment of $200,000. The after-tax cash flows are estimated at $84,980 for year 1, $169,200 for year 2, and $184,980 for year 3. The firm has a target debt/equity ratio of 1.39. The firm's cost of equity is 16.66% and its cost of debt is 11.86%. The tax rate is 34%. What is the NPV of this project? O $145,602 O $149,242 O $152,882 O $156,522 $160,162 You want to purchase shares of every IPO that comes to the market. The next two IPOs are each priced at $28.60 a share and will begin trading on the same day. Your broker allocates 830 shares of IPO A and 1,210 shares of IPO B to your account. At the end of the first day of trading, IPO A is selling for $33.90 a share and IPO B is selling for $24.50 a share. What is the absolute value of your combined net profit or loss on these two IPOs at the end of the first day of trading? $547.9 $562.0 $576.0 $590.1 $604.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts