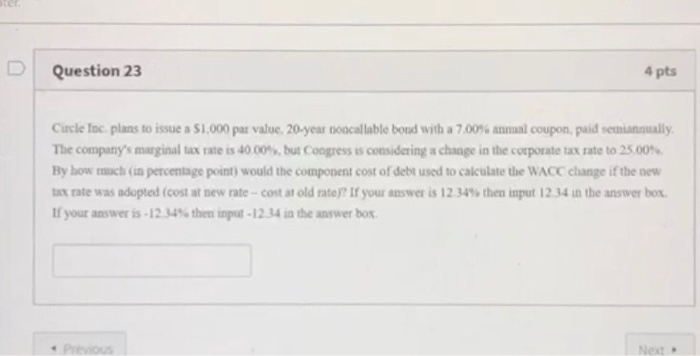

Question: Question 23 4 pts Circle Inc plans to issue a $1.000 par value. 20-year bacallable bond with a 7.00% amal coupon, paid semiannually The company's

Question 23 4 pts Circle Inc plans to issue a $1.000 par value. 20-year bacallable bond with a 7.00% amal coupon, paid semiannually The company's marginal tax rate is 40.00%. but Congress is considering a change in the corporate tax rate to 25.00% By how much (in percentage point) would the component cost of debt used to calculate the WACC change if the new tax rate was adopted (costat new rate-costat old rate)? If your answer is 12.34% then input 12 34 in the answer box If your answer is -12.34% the input-1234 in the answer box

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts