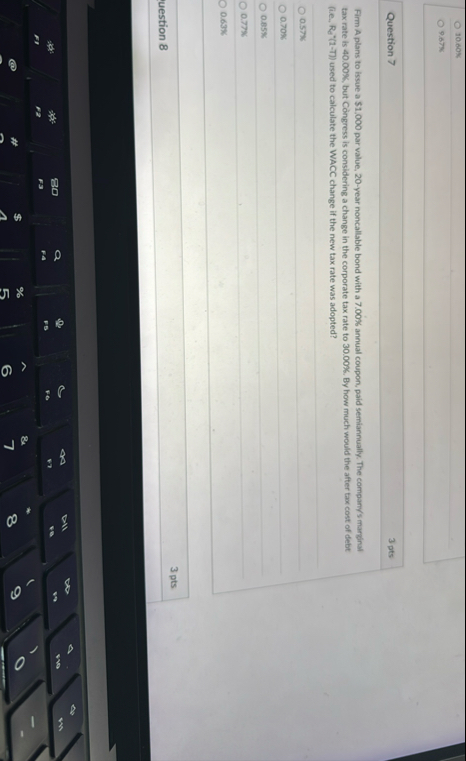

Question: 1 0 . 6 0 x 9 . 6 7 x Question 7 3 pts Firm A plans to issue a $ 1 , 0

x

x

Question

pts

Firm A plans to issue a $ par value, year noncallable bond with a annual coupon, paid semiannually. The companys marginal tax rate is but Congress is considering a change in the corporate tax rate to By how much would the after tax cost of debt ie used to calculate the WACC change if the new tax rate was adopted?

uestion

pts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock