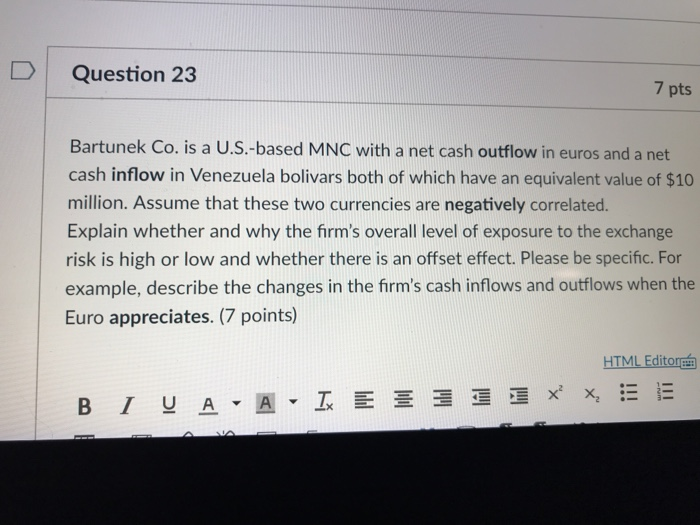

Question: Question 23 7 pts Bartunek Co. is a U.S.-based MNC with a net cash outflow in euros and a net cash inflow in Venezuela bolivars

Question 23 7 pts Bartunek Co. is a U.S.-based MNC with a net cash outflow in euros and a net cash inflow in Venezuela bolivars both of which have an equivalent value of $10 million. Assume that these two currencies are negatively correlated Explain whether and why the firm's overall level of exposure to the exchange risk is high or low and whether there is an offset effect. Please be specific. For example, describe the changes in the firm's cash inflows and outflows when the Euro appreciates. (7 points) HTML Editorg _x'x2

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock