Question: Question 23 An analyst formulates the following regression equation: '1'. = be + b1X1': + b2Xzi + Bi '1'. : Natural logarithm of the ratio

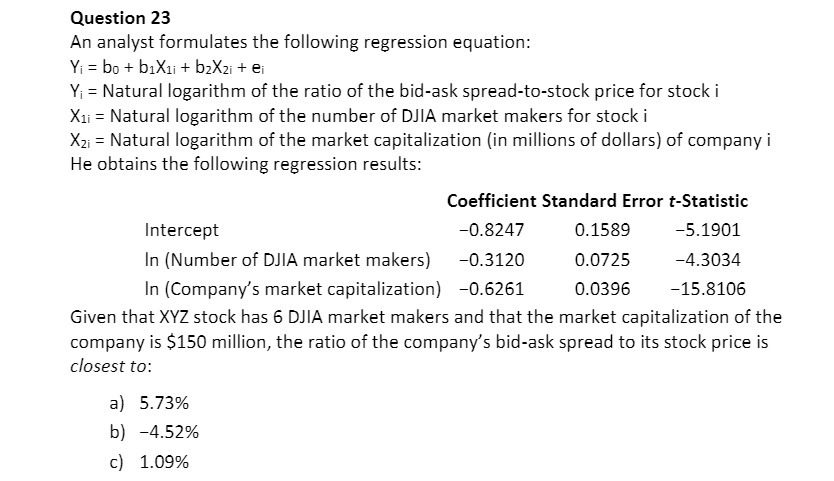

Question 23 An analyst formulates the following regression equation: '1'". = be + b1X1': + b2Xzi + Bi '1'\". : Natural logarithm of the ratio of the bid-ask spread-to-stock price for stock i X1: 2 Natural logarithm of the number of DJIA market makers for stock i Kai 2 Natural logarithm of the market capitalization [in millions of dollars} of company i He obtains the following regression results: Coefficient Standard Error t-Statistic Intercept 41824? 0.1589 5.1901 In {Number of DJIA market makers} .3120 0.0?25 4.3034 In {Company's market capitalization] .6261 0.0396 15.3106 Given that XYZ stock has E DJIA market makers and that the market capitalization of the company is $150 million, the ratio of the company's bid-ask spread to its stock price is closest to: a} 533% b) 4.52% c} 1.09%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts