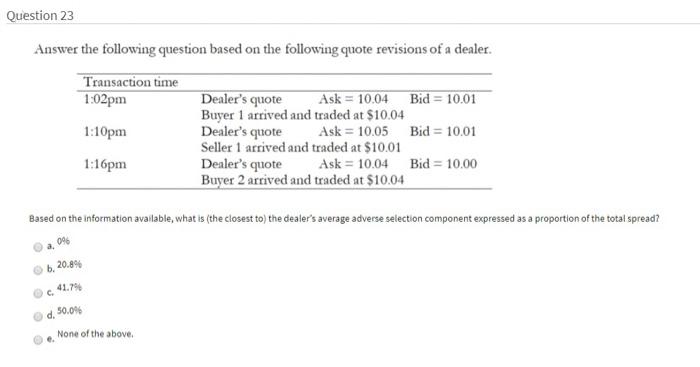

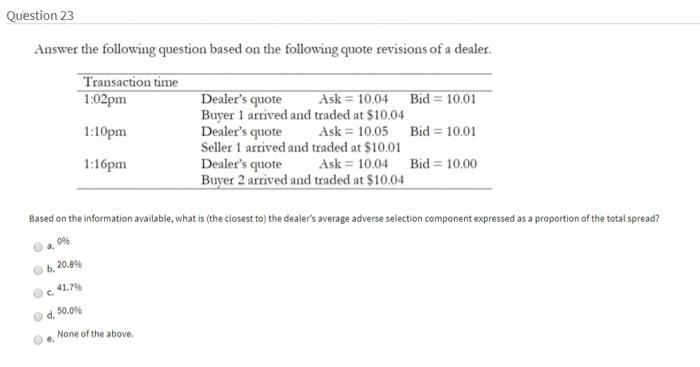

Question: Question 23 Answer the following question based on the following quote revisions of a dealer. Transaction time 1:02 pm 1:10 pm 1:16pm Dealer's quote Ask

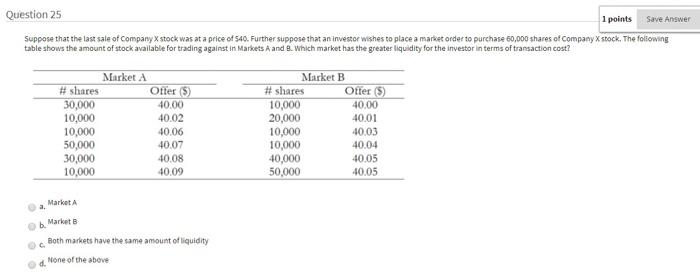

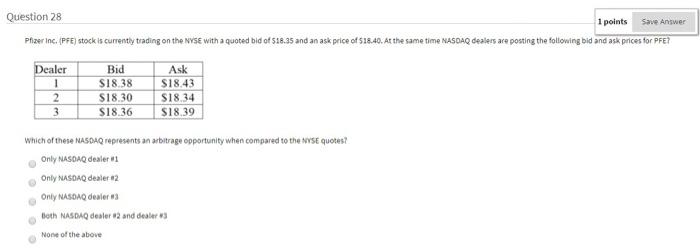

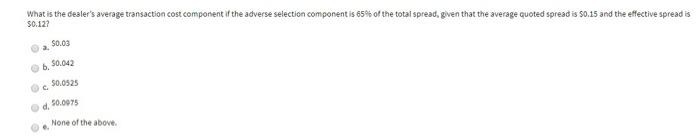

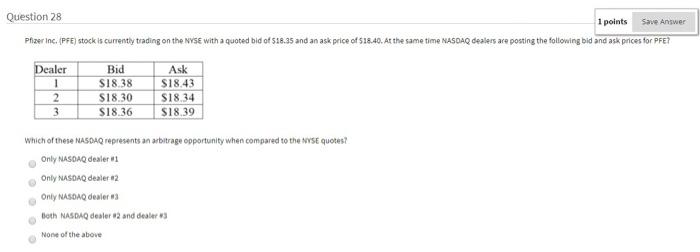

Question 23 Answer the following question based on the following quote revisions of a dealer. Transaction time 1:02 pm 1:10 pm 1:16pm Dealer's quote Ask = 10.04 Bid = 10.01 Buyer 1 arrived and traded at $10.04 Dealer's quote Ask = 10.05 Bid = 10.01 Seller 1 arrived and traded at $10.01 Dealer's quote Ask = 10.04 Bid = 10.00 Buyer 2 arrived and traded at $10.04 Based on the information available, what is (the closest to) the dealer's average adverse selection component expressed as a proportion of the total spread? 09 b. 20.89 41.794 d. 50.0% None of the above Question 25 1 points Save Answer Suppose that the last sale of Company X stock was at a price of 540. Further suppose that an investor wishes to place a market order to purchase 60,000 shares of Company stock. The following table shows the amount of stock available for trading against in Markets and 8. Which market has the greater liquidity for the investor in terms of transaction cost? Market A #shares Offer (5) 30,000 40.00 10,000 40.02 10,000 10.06 50,000 40.07 30,000 40.08 10,000 40.09 Market B # shares Offer (5) 10,000 40.00 20,000 40.01 10,000 40.03 10,000 40.04 40,000 40.05 50,000 40.05 Market A b. Market B Both markets have the same amount of liquidity d. None of the above Save Answer Question 28 1 points Pfizer Inc. (PFE) stock is currently trading on the Nyse with a quoted bid of 516.35 and an ask price of $18.40. At the same time NASDAQ dealers are posting the following bid and ask prices for PFE? Dealer 1 2 3 Bid SI838 S18.30 $18.36 Ask $18.43 S18.34 $18.39 Which of these NASDAQ represents an arbitrage opportunity when compared to the Nvse quotes? Only NASDAQ dealer Only NASDAQ dealer 12 Only NASDAQ dealer Both NASDAQ dealer 2 and dealers None of the above What is the dealer's average transaction cost component if the adverse selection component is 65% of the total spread, given that the average quoted spread is 50.15 and the effective spread is $0.127 S0.03 b. 50.042 50.0525 d. 50.0075 None of the above Question 23 Answer the following question based on the following quote revisions of a dealer. Transaction time 1:02 pm 1:10 pm 1:16pm Dealer's quote Ask = 10.04 Bid = 10.01 Buyer 1 arrived and traded at $10.04 Dealer's quote Ask = 10.05 Bid = 10.01 Seller 1 arrived and traded at $10.01 Dealer's quote Ask = 10.04 Bid = 10.00 Buyer 2 arrived and traded at $10.04 Based on the information available, what is (the closest to) the dealer's average adverse selection component expressed as a proportion of the total spread? 09 b. 20.89 41.794 d. 50.0% None of the above Save Answer Question 28 1 points Pfizer Inc. (PFE) stock is currently trading on the Nyse with a quoted bid of 516.35 and an ask price of $18.40. At the same time NASDAQ dealers are posting the following bid and ask prices for PFE? Dealer 1 2 3 Bid SI838 S18.30 $18.36 Ask $18.43 S18.34 $18.39 Which of these NASDAQ represents an arbitrage opportunity when compared to the Nvse quotes? Only NASDAQ dealer Only NASDAQ dealer 12 Only NASDAQ dealer Both NASDAQ dealer 2 and dealers None of the above Question 23 Answer the following question based on the following quote revisions of a dealer. Transaction time 1:02 pm 1:10 pm 1:16pm Dealer's quote Ask = 10.04 Bid = 10.01 Buyer 1 arrived and traded at $10.04 Dealer's quote Ask = 10.05 Bid = 10.01 Seller 1 arrived and traded at $10.01 Dealer's quote Ask = 10.04 Bid = 10.00 Buyer 2 arrived and traded at $10.04 Based on the information available, what is (the closest to) the dealer's average adverse selection component expressed as a proportion of the total spread? 09 b. 20.89 41.794 d. 50.0% None of the above Question 25 1 points Save Answer Suppose that the last sale of Company X stock was at a price of 540. Further suppose that an investor wishes to place a market order to purchase 60,000 shares of Company stock. The following table shows the amount of stock available for trading against in Markets and 8. Which market has the greater liquidity for the investor in terms of transaction cost? Market A #shares Offer (5) 30,000 40.00 10,000 40.02 10,000 10.06 50,000 40.07 30,000 40.08 10,000 40.09 Market B # shares Offer (5) 10,000 40.00 20,000 40.01 10,000 40.03 10,000 40.04 40,000 40.05 50,000 40.05 Market A b. Market B Both markets have the same amount of liquidity d. None of the above Save Answer Question 28 1 points Pfizer Inc. (PFE) stock is currently trading on the Nyse with a quoted bid of 516.35 and an ask price of $18.40. At the same time NASDAQ dealers are posting the following bid and ask prices for PFE? Dealer 1 2 3 Bid SI838 S18.30 $18.36 Ask $18.43 S18.34 $18.39 Which of these NASDAQ represents an arbitrage opportunity when compared to the Nvse quotes? Only NASDAQ dealer Only NASDAQ dealer 12 Only NASDAQ dealer Both NASDAQ dealer 2 and dealers None of the above What is the dealer's average transaction cost component if the adverse selection component is 65% of the total spread, given that the average quoted spread is 50.15 and the effective spread is $0.127 S0.03 b. 50.042 50.0525 d. 50.0075 None of the above Question 23 Answer the following question based on the following quote revisions of a dealer. Transaction time 1:02 pm 1:10 pm 1:16pm Dealer's quote Ask = 10.04 Bid = 10.01 Buyer 1 arrived and traded at $10.04 Dealer's quote Ask = 10.05 Bid = 10.01 Seller 1 arrived and traded at $10.01 Dealer's quote Ask = 10.04 Bid = 10.00 Buyer 2 arrived and traded at $10.04 Based on the information available, what is (the closest to) the dealer's average adverse selection component expressed as a proportion of the total spread? 09 b. 20.89 41.794 d. 50.0% None of the above Save Answer Question 28 1 points Pfizer Inc. (PFE) stock is currently trading on the Nyse with a quoted bid of 516.35 and an ask price of $18.40. At the same time NASDAQ dealers are posting the following bid and ask prices for PFE? Dealer 1 2 3 Bid SI838 S18.30 $18.36 Ask $18.43 S18.34 $18.39 Which of these NASDAQ represents an arbitrage opportunity when compared to the Nvse quotes? Only NASDAQ dealer Only NASDAQ dealer 12 Only NASDAQ dealer Both NASDAQ dealer 2 and dealers None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts