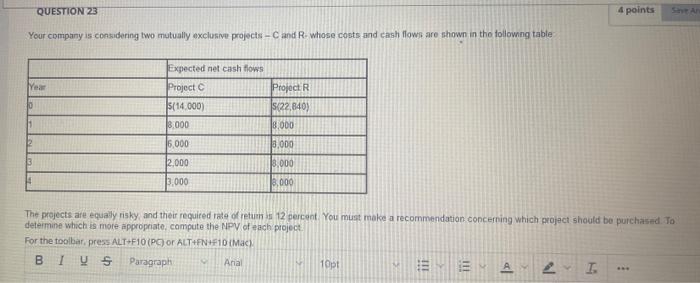

Question: QUESTION 23 Your company is considering two mutually exclusive projects - C and R- whose costs and cash flows are shown in the following table

QUESTION 23 Your company is considering two mutually exclusive projects - C and R- whose costs and cash flows are shown in the following table Year 10 11 2 3 Expected net cash flows Project C $(14.000) 8.000 6,000 2.000 3,000 Project R S(22,840) 8,000 3,000 8,000 3.000 The projects are equally risky, and their required rate of retum is 12 percent. You must make a recommendation concerning which project should be purchased. To determine which is more appropriate, compute the NPV of each project. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph M Arial 10pt 4 points Save An EYEYAY 2 L www

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts