Question: Question 24 (4 marks) The top-down approach to fundamental analysis includes an analysis of the local economy in which a company is situated, plus the

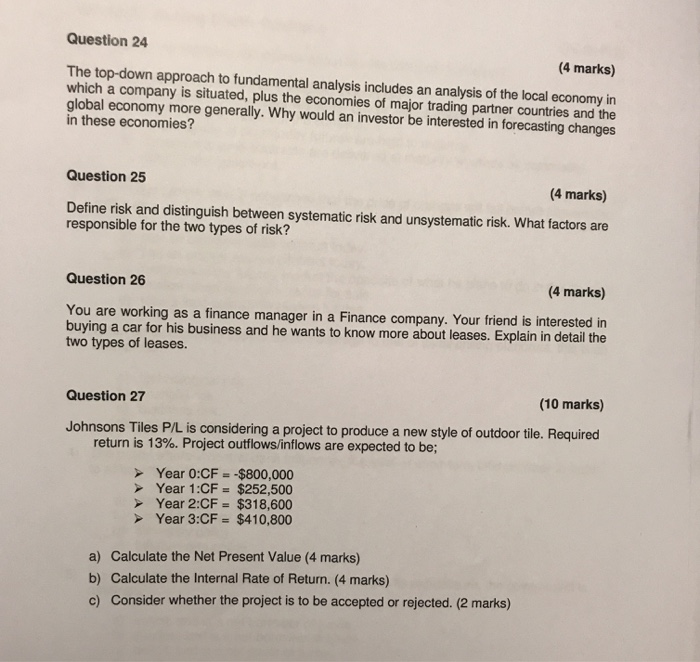

Question 24 (4 marks) The top-down approach to fundamental analysis includes an analysis of the local economy in which a company is situated, plus the economies of major trading partner countries and the global economy more generally. Why would an investor be interested in forecasting changes in these economies? Question 25 (4 marks) Define risk and distinguish between systematic risk and unsystematic risk. What factors are responsible for the two types of risk? Question 26 (4 marks) You are working as a finance manager in a Finance company. Your friend is interested in buying a car for his business and he wants to know more about leases. Explain in detail the two types of leases. (10 marks) Question 27 Johnsons Tiles P/L is considering a project to produce a new style of outdoor tile. Required return is 13%. Project outflows/inflows are expected to be; Year 0:CF--$800, 000 Year 1:CF = $252,500 Year 2:CF $318,600 Year 3:CF= $410,800 a) Calculate the Net Present Value (4 marks) b) Calculate the Internal Rate of Return. (4 marks) c) Consider whether the project is to be accepted or rejected. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts