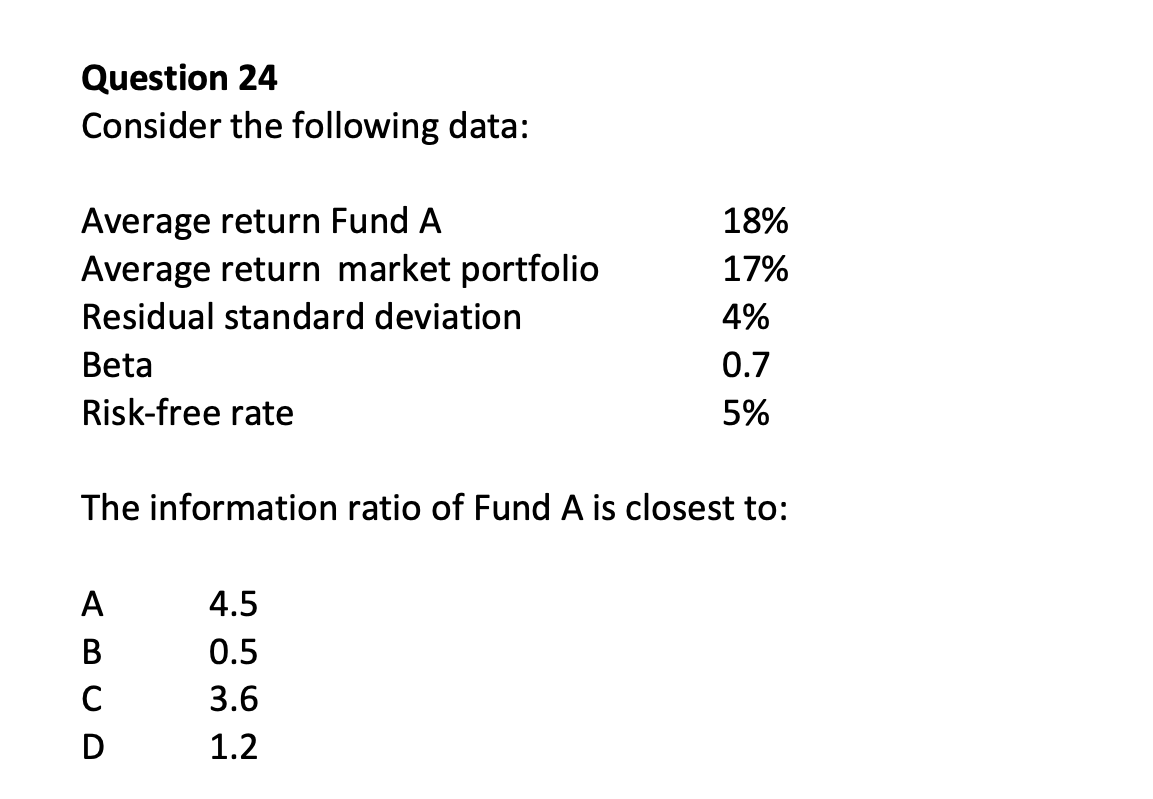

Question: Question 24 Consider the following data: Average return Fund A Average return market portfolio Residual standard deviation Beta Risk-free rate 18% 17% 4% 0.7

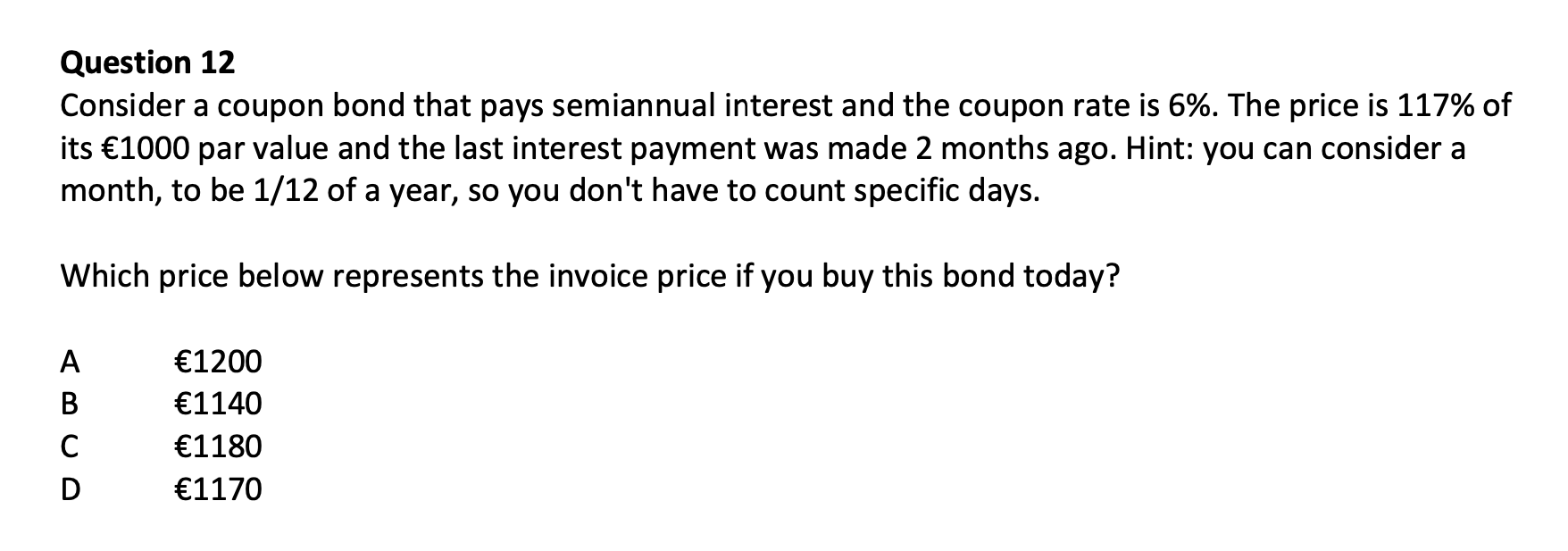

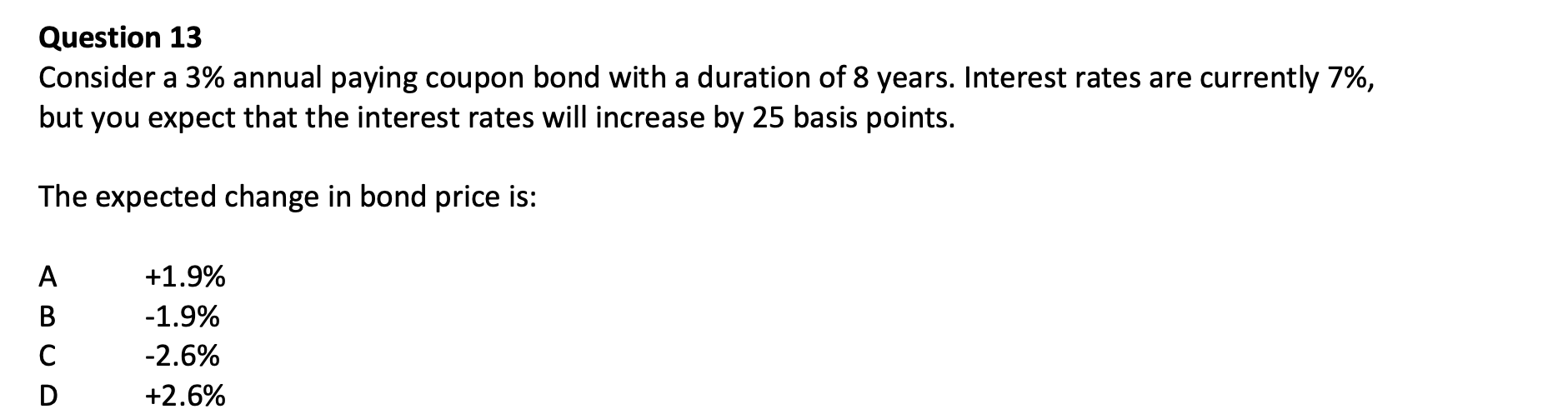

Question 24 Consider the following data: Average return Fund A Average return market portfolio Residual standard deviation Beta Risk-free rate 18% 17% 4% 0.7 5% The information ratio of Fund A is closest to: ABCD 4.5 0.5 3.6 1.2 Question 12 Consider a coupon bond that pays semiannual interest and the coupon rate is 6%. The price is 117% of its 1000 par value and the last interest payment was made 2 months ago. Hint: you can consider a month, to be 1/12 of a year, so you don't have to count specific days. Which price below represents the invoice price if you buy this bond today? ABCD D 1200 1140 1180 1170 Question 13 Consider a 3% annual paying coupon bond with a duration of 8 years. Interest rates are currently 7%, but you expect that the interest rates will increase by 25 basis points. The expected change in bond price is: ABCD +1.9% -1.9% -2.6% +2.6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts