Question: QUESTION 24 James is considering purchasing an 11-year bond that is selling for $1,250. What is the current yield for this bond if it has

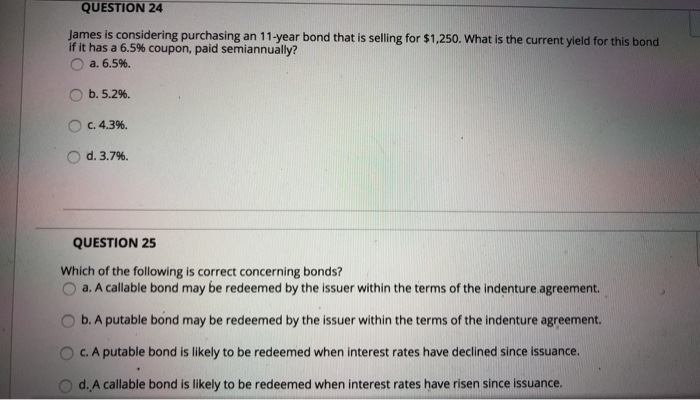

QUESTION 24 James is considering purchasing an 11-year bond that is selling for $1,250. What is the current yield for this bond if it has a 6.5% coupon, paid semiannually? O a. 6.5%. b.5.2%. c. 4.3%. d. 3.7% QUESTION 25 Which of the following is correct concerning bonds? a. A callable bond may be redeemed by the issuer within the terms of the indenture agreement. b. A putable bond may be redeemed by the issuer within the terms of the indenture agreement. OC. A putable bond is likely to be redeemed when interest rates have declined since issuance. Od. A callable bond is likely to be redeemed when interest rates have risen since issuance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts