Question: QUESTION 3 Brandy is considering purchasing an 8-year bond that is selling for $700. What is the current yield for this bond if it has

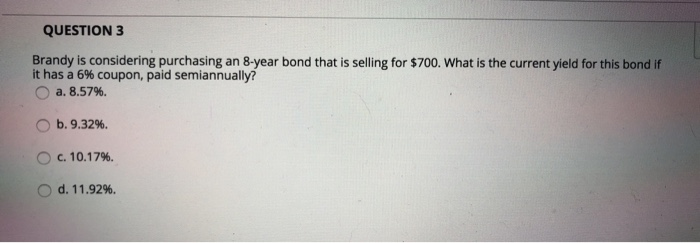

QUESTION 3 Brandy is considering purchasing an 8-year bond that is selling for $700. What is the current yield for this bond if it has a 6% coupon, paid semiannually? O a. 8.57% b. 9.32%. O c. 10.17%. d. 11.92%. QUESTION 5 Jackson owns a twenty-year zero-coupon bond priced at $551. If interest rates increase by 50 basis points, how much will the bond change? O a. The price will decrease less than 5%. b. The price will increase less than 5%. OC. The price will decrease between 5% and 10%. d. The price will decrease more than 10%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock