Question: QUESTION 24 Using Variable Costing, calculate Operating Income for January: FACTS: Marty's Entrees produces frozen meals, which it sells for $9 each. The company uses

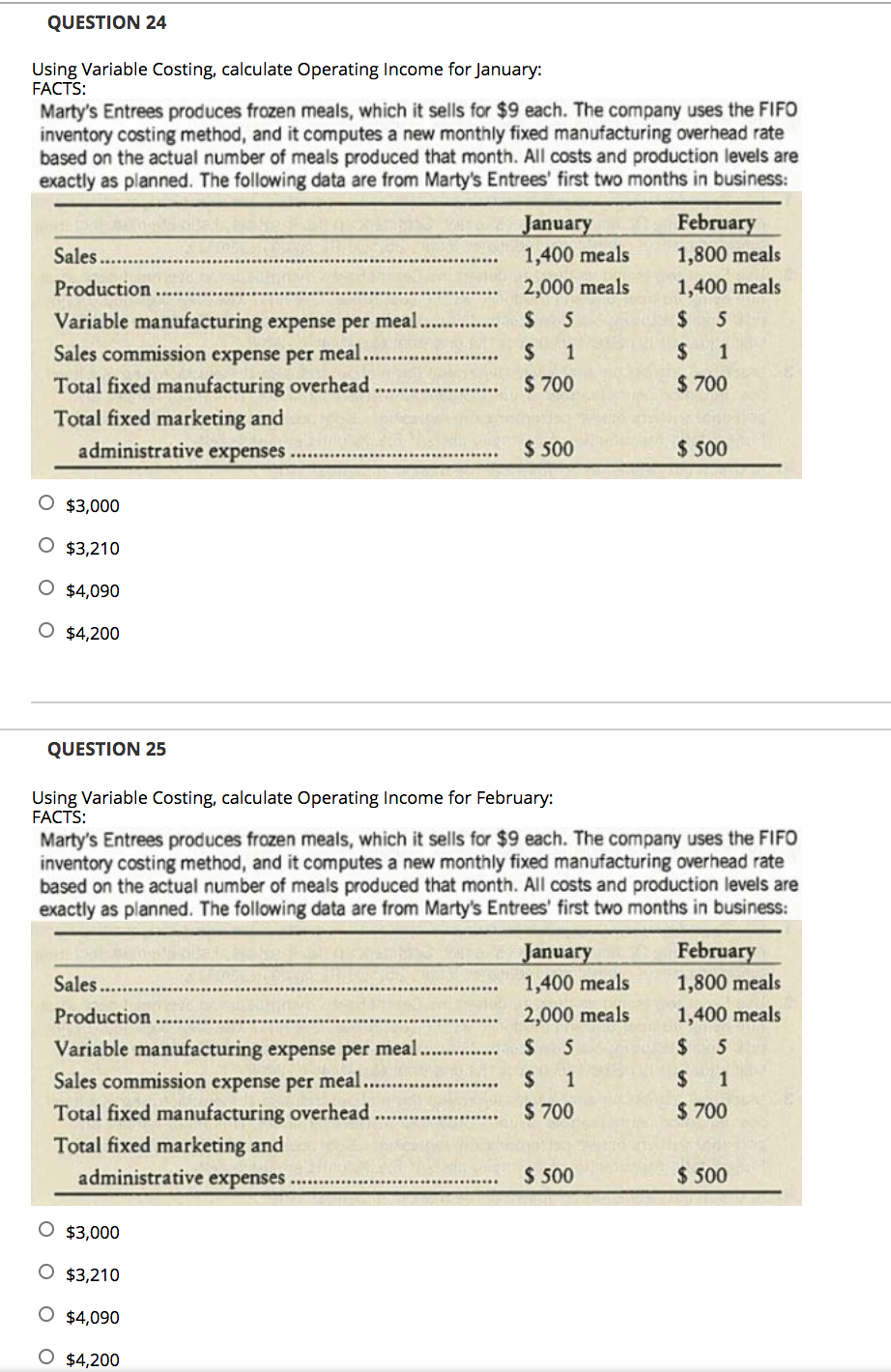

QUESTION 24 Using Variable Costing, calculate Operating Income for January: FACTS: Marty's Entrees produces frozen meals, which it sells for $9 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from Marty's Entrees' first two months in business: January February 1,400 meals 1,800 meals Production 2,000 meals 1,400 meals Variable manufacturing expense per meal. $ $ Sales commission expense per meal.. $ $ Total fixed manufacturing overhead $ 700 $ 700 Total fixed marketing and administrative expenses $ 500 $ 500 Sales .... u 5 1 1 O $3,000 O $3,210 $4,090 $4,200 QUESTION 25 Using Variable Costing, calculate Operating Income for February: FACTS: Marty's Entrees produces frozen meals, which it sells for $9 each. The company uses the FIFO inventory costing method, and it computes a new monthly fixed manufacturing overhead rate based on the actual number of meals produced that month. All costs and production levels are exactly as planned. The following data are from Marty's Entrees' first two months in business: January February Sales 1,400 meals 1,800 meals Production 2,000 meals 1,400 meals Variable manufacturing expense per meal. $ 5 $ 5 Sales commission expense per meal. $ 1 $ 1 Total fixed manufacturing overhead $ 700 $ 700 Total fixed marketing and administrative expenses $ 500 $ 500 $3,000 $3,210 O $4,090 O $4,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts