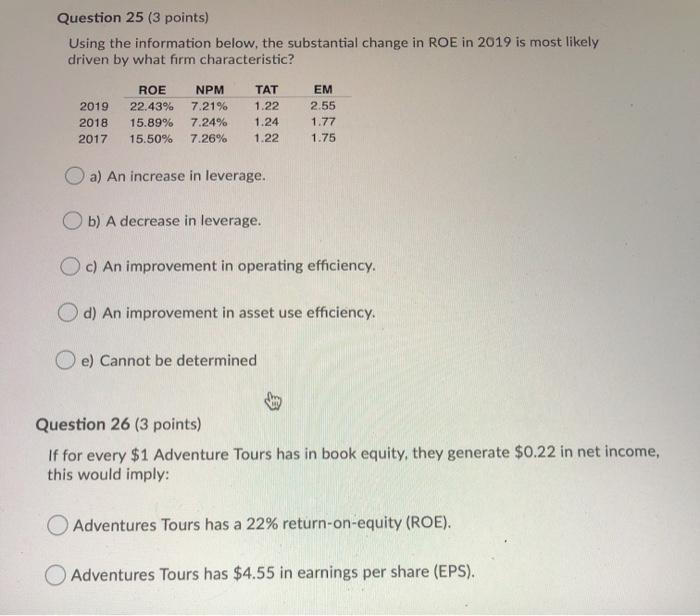

Question: Question 25 (3 points) Using the information below, the substantial change in ROE in 2019 is most likely driven by what firm characteristic? 2019 2018

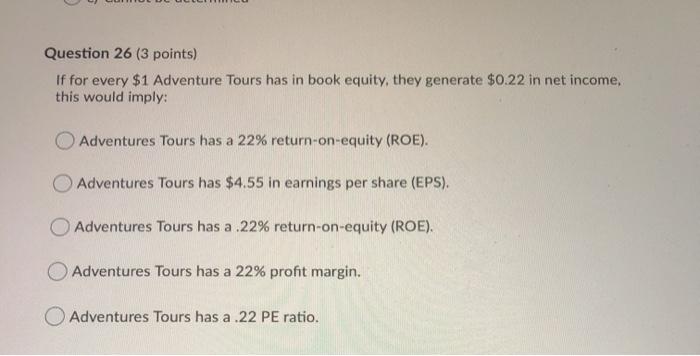

Question 25 (3 points) Using the information below, the substantial change in ROE in 2019 is most likely driven by what firm characteristic? 2019 2018 2017 ROE 22.43% 15.89% 15.50% NPM 7.21% 7.24% 7.26% TAT 1.22 1.24 1.22 EM 2.55 1.77 1.75 a) An increase in leverage. b) A decrease in leverage. c) An improvement in operating efficiency. d) An improvement in asset use efficiency. Oe) Cannot be determined Question 26 (3 points) If for every $1 Adventure Tours has in book equity, they generate $0.22 in net income, this would imply: Adventures Tours has a 22% return-on-equity (ROE). Adventures Tours has $4.55 in earnings per share (EPS). Question 26 (3 points) If for every $1 Adventure Tours has in book equity, they generate $0.22 in net income, this would imply: Adventures Tours has a 22% return-on-equity (ROE). Adventures Tours has $4.55 in earnings per share (EPS). Adventures Tours has a 22% return-on-equity (ROE). Adventures Tours has a 22% profit margin. Adventures Tours has a .22 PE ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts