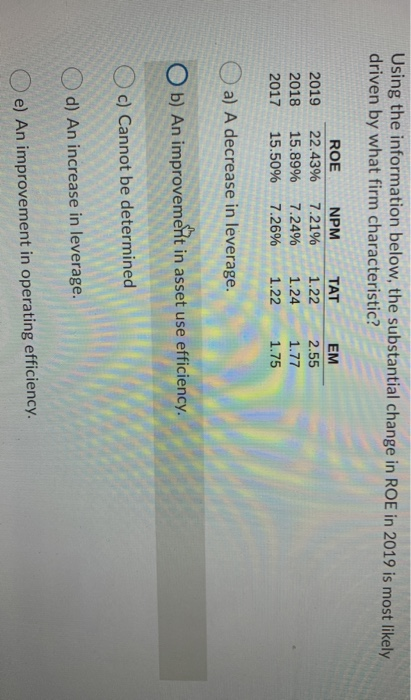

Question: Using the information below, the substantial change in ROE in 2019 is most likely driven by what firm characteristic? 2019 2018 2017 ROE 22.43% 15.89%

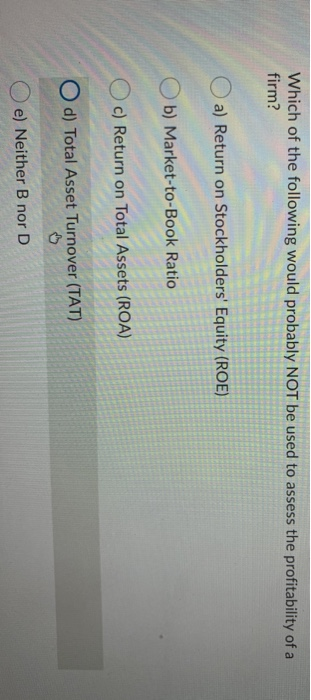

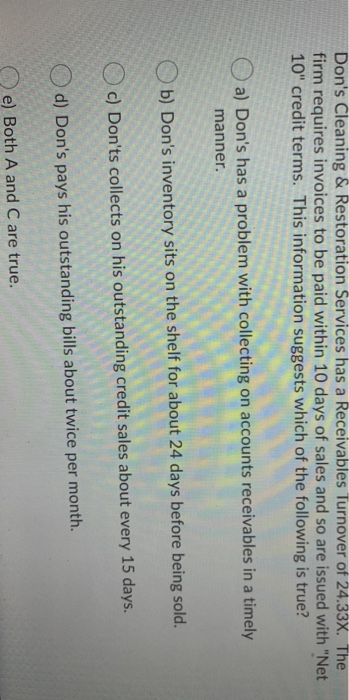

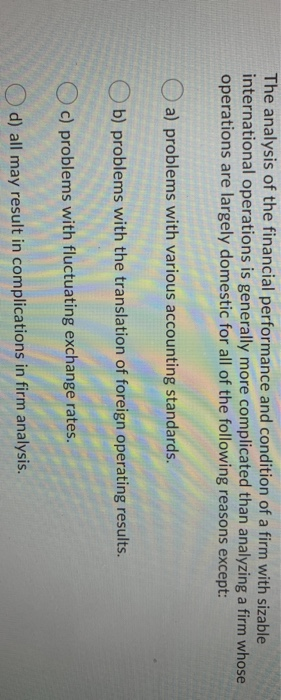

Using the information below, the substantial change in ROE in 2019 is most likely driven by what firm characteristic? 2019 2018 2017 ROE 22.43% 15.89% 15.50% NPM 7.21% 7.24% 7.26% TAT 1.22 1.24 1.22 EM 2.55 1.77 1.75 a) A decrease in leverage. Ob) An improvement in asset use efficiency. c) Cannot be determined d) An increase in leverage. e) An improvement in operating efficiency. Which of the following would probably NOT be used to assess the profitability of a firm? a) Return on Stockholders' Equity (ROE) b) Market-to-Book Ratio c) Return on Total Assets (ROA) O d) Total Asset Turnover (TAT) e) Neither B nor D Don's Cleaning & Restoration Services has a Receivables Turnover of 24.33x. The firm requires invoices to be paid within 10 days of sales and so are issued with "Net 10" credit terms. This information suggests which of the following is true? a) Don's has a problem with collecting on accounts receivables in a timely manner. b) Don's inventory sits on the shelf for about 24 days before being sold. Oc) Don'ts collects on his outstanding credit sales about every 15 days. d) Don's pays his outstanding bills about twice per month. e) Both A and C are true. The analysis of the financial performance and condition of a firm with sizable international operations is generally more complicated than analyzing a firm whose operations are largely domestic for all of the following reasons except: a) problems with various accounting standards. b) problems with the translation of foreign operating results. O c) problems with fluctuating exchange rates. d) all may result in complications in firm analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts