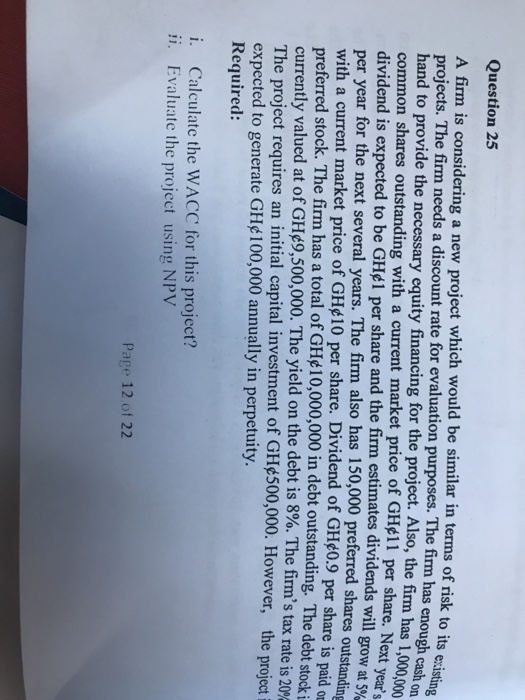

Question: Question 25 A firm is considering a new project which would be similar in terms of risk to its existin projects. The firm needs a

Question 25 A firm is considering a new project which would be similar in terms of risk to its existin projects. The firm needs a discount rate for evaluation purposes. The firm has enough cash o hand to provide the necessary equity financing for the project. Also, the firm has 1,00. common shares outstanding with a current market price of GHe11 per share. Next veare dividend is expected to be GHfl per share and the firm estimates dividends will grow at5% per year for the next several years. The firm also has 150,000 preferred with a current market price of GHe10 per share. Dividend of GHeo.9 preferred stock. The firm has a total of GH#10,000,000 in debt outstanding. The debt stock currently valued at of GH9,500,000. The yield on the debt is 8%. The firm's tax rate is 20% The proje expected to generate GHe100,000 annually in perpetuity. Required: shares outstanding per share is paid o ct requires an initial capital investment of GHe500,000. However, the project Calculate the WACC for this project? Evaluate the project using NPV i. ii. Page 12 of 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts